AEP Plantations (AEP) - Improving capital allocation, 7x free cash flow with >40% market cap in cash

Opportunity to join an activist campaign to unlock shareholder value

AEP Plantations (AEP) listed on the LSE in the UK, was a stock pick for Real Worth Stocks members on 7th June 2024 at 670p: currently it’s at 1400p, plus dividends of 77p for a total return of +220%. This post explains why it’s still good value, and what catalyst could unlock even more value.

AEP Plantations Business Model:

AEP Plantations is a palm oil company, with all operations in Indonesia - the world’s top palm oil producing country: see below. Palm oil is produced from the fleshy fruits of the palm tree, which are processed in mills into crude palm oil (CPO). The palm kernels can also be processed to produce palm kernel oil. This is sold to local buyers or exported.

The stock has been recommended multiple times to members since then - each time more shares have been added to the Real Worth Stocks portfolio. It currently comprises 14% of the portfolio: the third largest holding of twelve.

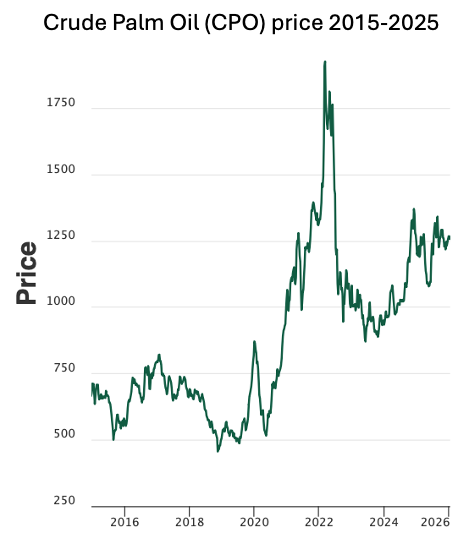

Market for Crude Palm Oil (CPO): AEP’s main product

AEP has one main product: crude palm oil (CPO) so the price of this commodity drives their revenues and profits. Pre-pandemic, the price was around $500-$750/tonne from 2015-2020, but then there was a huge spike in price in 2021 and early 2022, up to $1900/tonne. Prices then settled to a lower level in 2023-2024, before picking up to average around $1200/tonne in 2024-5. At this price, palm oil production is very profitable: in H1 2025 AEP made £37M in free cash flow, which is about 7% of their market cap in 6 months.

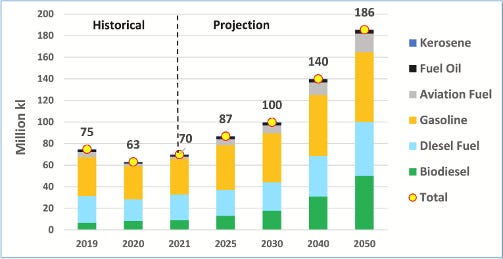

The Indonesian market for palm oil is also being driven by an increase in demand from biodiesel (made from CPO): the government has mandated an increasing percentage of biodiesel in the diesel sold there, starting with 10% in 2016, and now 40% in 2025. There was a plan to further increase this to 50% in 2026, but this was put on hold on 14th January, due to the falling oil price. However, should the oil price increase then this is likely to go ahead.

Due to the population increase over time in Indonesia driving fuel demand, there are forecasts for significant increases in biodiesel demand over time: see chart below:

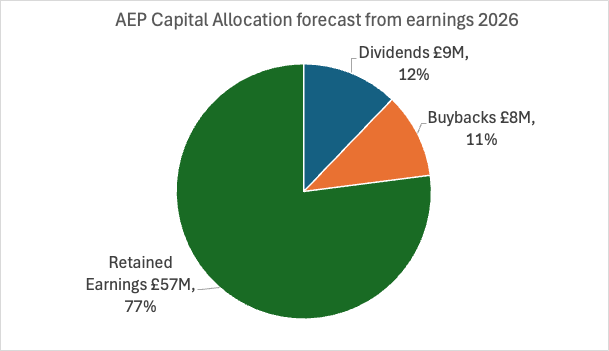

Capital Allocation of 2026 Earnings

I assume that AEP earn £74M in cash in 2026, as they are estimated to have done in 2025. They have announced an £8M buyback scheme for H1 26, and are likely to pay a dividend of £9M in the year of 2026. This means that they will likely retain 77% of 2026 earnings.

Capital Allocation of Retained Earnings on AEP’s Balance Sheet

AEP as of H1 25 had £183M of surplus cash over and above their working capital on their balance sheet, vs a market cap of £531M. By Dec-25, I have estimated based on the CPO price in 2025, that they will have £223M of surplus cash on their balance sheet: this is 42% of the market cap: and the company is valued at just 7x free cash flow, at 1400 p/share. If they continue with their already announced share buyback and dividend plans, by Dec-26 they will have £270M of cash on their balance sheet: which is 51% of the market cap!

This cash is not being valued by the market, because a very similar company called M.P. Evans who also produce palm oil in Indonesia, and are also listed on the LSE, are valued at a similar P/E ratio to AEP, but don’t have a huge cash pile.

The market is discounting the value of AEP’s cash; possibly because:

AEP have not announced their H2 2025 results yet, so people do not know how much cash they have, or

People believe that the cash will just sit on the balance sheet and not be put to work to earn a good return.

Of course, AEP could reinvest capital to purchase more palm oil plantation assets. However, there is a limit of 100,000 hectares per palm oil company imposed by the Indonesian government. With a reasonable assumption of a purchase price of $12,000/hectare, AEP already have enough cash on hand as of Dec-25 to hit this limit: and they could not possibly buy all of this land at once since it would mean expanding their planted area by 50% or so. Rather, I think that they should distribute surplus cash, and invest in more land gradually, from ongoing profits from their operations.

How could AEP return cash to shareholders?

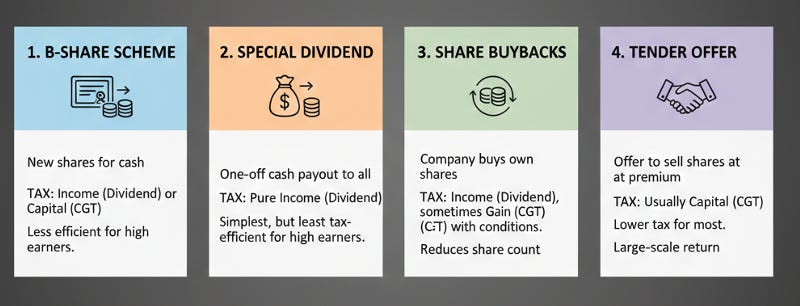

Here are a few ways AEP could return cash to shareholders:

B-share scheme: this is where AEP issues new shares pro rata to existing shareholders, then pays cash to buy them back at a set price and cancels them, reducing their capital in the process. If structured correctly, this may be able to be done as a return of capital, potentially avoiding capital gains taxes. It would enable as much cash as desired to be returned.

Special dividend: this would trigger dividend taxes for shareholders, but would enable the company to return as much cash as it desired.

Share buybacks: these are limited to 25% of the daily trading volume: so are limited in their scope since AEP is >50% owned by the Genton trust, and 17% owned by Nokia Bell Pensioendfonds, a Belgian pension fund, so the free float is more limited

Tender Offer: again this would allow as much cash as desired to be returned to shareholders, by AEP setting a price for repurchasing shares, and requesting shareholders to tender their holdings at that price.

Action to persuade the AEP board to Improve Capital Allocation:

If you would like to get involved in campaigning for the board to return capital to investors, and also better communicate a capital allocation policy, contact me through Substack, or DM me on X at x.com/realworthstocks. An improved capital allocation policy could be the catalyst to unlock substantial shareholder value. Even if this does not happen, the stock currently gives a 14% free cash flow yield, with 42% of the market cap in surplus cash so there is good downside protection and growth.

I have written twice to the board to urge them improve capital allocation: please see my first two letters to them below.

In the first letter, I urged the board to convert their cash holdings from Indonesian rupiah (INR) to US dollars (USD), because the rupiah’s value was depreciating, losing shareholder value. In their response, they confirmed that they were doing this and were 40% complete as of April 2025.

In my second letter in January 2026, I advocate for a large return of capital to shareholders. I have not yet received a response to this letter.

Disclosure: I have a long position in AEP Plantations (AEP). While every effort has been made to ensure the accuracy of the information in this post, no guarantee is given as to its accuracy. This is not investment advice.