Albertsons (ACI) takeover by Kroger: merger arbitrage opportunity

Deal and no-deal scenarios analysed with the Kelly Formula

Today I will discuss a mega-takeover in the US grocery market, the $24.6B acquisition of Albertsons (ACI) by Kroger (KR) for $34.10 per share. This is a potential merger arbitrage opportunity, since Albertsons currently (early Jun-23) trades for $20.50 per share.

Takeover Odds and the Kelly Formula

Albertsons has already paid a special dividend connected to the proposed takeover to it’s shareholders, of $6.85 per share, which was part of the merger consideration, which reduces the price remaining to $34.10-$6.85 = $27.15: which is a 33% premium to the current Albertsons share price of $20.50.

There are two main reasons for the price gap:

The deal may not close at all: it is currently undergoing an antitrust review.

The deal may close, but with divestment of a number of Albertsons and Kroger stores in order to satisfy regulators: in this case, shareholders of Albertsons would receive spinoff shares in a new company holding the divested stores.

It is unclear currently how many stores would have to be divested in order for the US FTC (Federal Trade Comission) to approve the deal - but Kroger’s offer is subject to a cap of 650 stores according to the merger documents - more than this and Kroger is not obligated to complete the deal. The 14C schedule SEC filing anticipates a minimum of 100 stores will be divested, into the spinoff company.

Application of Kelly Formula to the deal

The Kelly formula allows us to determine the probability that the market is assigning to the deal closure, since we know the price if the deal goes through, and if we assume a market price for the shares should the deal not go through, and we assume also that a market-type return of near 10% is expected for those participating in the deal by investing now in Albertsons shares.

The price if the deal should go through is the merger consideration of $34.10 minus the special dividend of $6.85 already paid out, which is $34.10 - $6.85 = $27.25. This represents a premium of $27.25 - $20.5 = $6.75 to the current Albertsons share price.

To obtain an estimate for the Albertsons share price should the deal fall through, we can look at the trading history of the stock prior to the deal announcement in October 2022. ACI shares traded in a range of $24.13 - $36.16 in the 12 months prior to the deal announcement, with the minimum price of $24.13 being reached in early October-22 just prior to the deal announcement. If we take this minimum price, and adjust for the special dividend subsequently paid out, this makes a share price of $24.13 - $6.85 = $17.28.

The current share price is $20.50, so if the deal falls through, then share price drop given these assumptions, would be $20.50 - $17.28 = $3.22.

In summary the per share projections in the deal and no deal scenarios are:

Current share price = $20.50

If deal goes through = $27.25, profit $6.75

If deal falls apart predicted = $17.28, loss $3.22

If we assume for example a 50% probability of the deal closing, then the probability-weighted outcome is: $6.75*50% -$3.22*50% = $1.77. On the share purchase price of $20.5, this is a $1.77/$20.5 = 8.6% return. The deal is supposed to close sometime in early 2024: if it actually closes in Jun-24, that would be a 1 year period until the outcome, giving a probability-weighted return outcome of ~9%: which is not very attractive compared to a market-type return of ~10%. So based on the assumptions made about the share price if the deal falls through, we could say that the market is currently assigning about a 50% probability of deal closure in a period of a year.

However, two things could potentially improve this return:

If we believe that the chances of the deal closing are higher than 50%, e.g. 75%. In this case, the probability weighted return is $6.75*0.75 - $3.22*0.25 = $4.26, divided by the share price now of $20.5 = 21% return in 12 months, which is more attractive.

Waiting to invest for six months: if the situation re. antitrust judgement is still unclear by then, and the share price has not moved significantly, but the merger is still expected to close in the same time period, (and we still assume a 50% probability of deal closure), the return would be 9%, but over a six month period, which is an annualised return of: 1.09^(12/6)-1 = 19%.

Given that this is very major takeover in the grocery space, I would expect significant regulatory scrutiny, and therefore the timetable laid out in the Albertsons 14C filing may slip, so it could take more than 1 year to close, especially given that Albertsons and Kroger will definitely have to engage in negotiations with the regulators about how many stores they would have to divest to effect the takeover.

The Kelly formula also tells us how much of our portfolio we should bet on this opportunity, based on the odds and return assumptions made above:

% of portfolio to invest = edge/odds

Edge is the weighted outcome, divided by the initial stake: i.e. (6.75*50% - 3.22*50%)/20.5 = 8.6%

Odds is the ratio of the winnings to the initial stake or 27.25/20.5 = 1.33

% of portfolio to invest according to Kelly formula = 0.086/1.33 = 6.5%.

However, for the reasons mentioned above re: the probability weighted return, now may not be the optimal time to invest if you want market-beating type returns.

Albertsons: The Business. (What You Get If The Deal Falls Through)

Deal break fee

There is a $600M break fee if Kroger decides not to complete the merger, which is payable by 13th January 2024, (this deadline can be extended to 13th October 2024 by agreement). However, if the deal fails to close due to an antitrust order or injunction by any US government agency, this break fee is not payable. In my opinion, antitrust issues, are by far the single most likely reason that the deal would fail: therefore if it does fail, it is quite unlikely that Albertsons will receive this fee.

History of Albertsons:

Albertons is a collection of multiple grocery retail brands and also pharmacies in the US as shown below, with 2276 stores, 1722 pharmacies, and 1317 in-store coffee shops, selling 34% fresh and 56% nonperishable goods. Albertsons was formed by the acquisitions of various tranches of stores over time by Cerberus Capital Management, a private equity investment firm, and by the 2015 $9.2B acquisition of Safeway.

The graphic below shows the locations of Kroger and Albertsons stores - source is www.businessinsider.com. It can be seen that the business combination is fairly complementary overall, except for major overlaps in LA, Texas and New York.

Durability:

Albertsons has some leverage on the balance sheet - currently having an enterprise value of $18.5B with a market cap of $11.6B, with a total of $8.5B long term debt. It could sell off some stores if required to raise capital: having $15.3B of PP&E on the balance sheet. Although it generated $10.3B total cash flow from operations in the last three years, it also spent $5.4B on PP&E, giving free cash flow of $4.9B in three years or $1.6B/year. So the debt can be serviced and paid off using the free cash flow if required - but this will take time and could become an issue in 2026 if credit conditions tighten. This is discussed further below.

Long term debt maturity profile

Most of the long term debt of Albertsons was refinanced in 2019-2020, and the maturity profile in $M/year is shown below. Interestingly, there is almost zero debt due in 2024 and 2025, which gives Cerberus a window to sell their stake in Albertsons, before the debt needs to be paid or refinanced again. The 2026 debt due is quite significant, at 1.7x annual free cash flow, so would need to be partially paid down prior to 2026 or refinanced before then.

Defined benefit pension schemes and multi-employer schemes

Albertsons has a deficit of $338M in its defined benefit Safeway plan, which is still open to union employees. It is also bound by union agreements to contribute to 27 different multi-employer defined benefit pension plans, several of which are in deficit. Albertsons estimates it’s share of the underfunding of these plans to be around $4.9B. However, under the American Rescue Plan Act, passed in Mar-21, eligible multi-employer pension plans can apply for a one-time cash payment to pay their obligations until 2051, from the US Government. One of the multi-employer plans that Albertsons contributes to, applied for $1.2B under this programme.

Quality of earnings

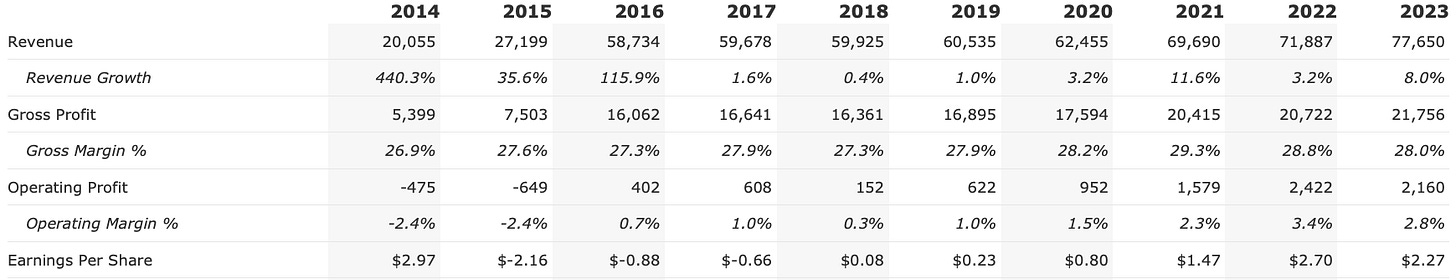

Grocery stores operate on thin margins, and operational execution is key in this industry in order to maintain and grow margins. Looking at Albertson’s revenue from 2016 onwards after the Safeway acquisition in the table below, we can see a steady growth, with a big boost in FY2021 due to the Covid pandemic, and that there has been additional growth over the last year.

Benefits of operating leverage:

Gross margins have remained fairly constant at 27%-28%, but operating margin expanded from 0.7% in 2016 to 2.8% in 2023, leading to ~5x growth in profits over this period. This is because selling and administrative expenses have not grown as fast as the growth in sales. Selling & administrative expenses consist of ‘store and corporate employee-related costs such as salaries and wages, health and welfare, workers' compensation and pension benefits, as well as marketing and merchandising, rent, occupancy and operating costs, amortization of intangibles and other administrative costs.’ Many of these costs do not increase significantly with increased revenues. We can calculate a sales per square foot figure for 2017 and 2023: in early 2017 Albertsons had sales/sq ft of $521, and in 2023 sales/sq ft of $688, a 33% increase. In this period inflation was 24%, so they grew sales/sq ft in real terms by 7% over the period, for a CAGR of 1%. Albertsons actually shrunk the total sq. ft. of their total store estate by 2% in this period, while increasing their store count by 1%: so their average store size decreased slightly.

Therefore the significant 5x growth in profits over this period is due to the operational leverage of the grocery industry - many store overhead costs are relatively fixed, so profits jump up, when sales increase.

Albertsons has 290,000 employees, of which 200,000 are unionised, and concludes collective bargaining agreements with its employees. Notably, in 2018 they had 275,00 employees, and so headcount grew by 5.5% in the 2018-2023 period, when sales grew by 29.6%, so they are operating more efficiently now.

Prospects for further improvement in operating margins at Albertsons?

The Albertsons operating margin has averaged 2.8% in the last two years, which is better than the Kroger 3-year operating margin of 2.5%, which is also Kroger’s 10 year operating margin average. This suggests that there is not much more room to improve operating margins at Albertsons, and also that Cerberus as the private equity owners of Albertsons, have successfully executed a turnaround, bringing it to at or above industry peer profitability levels. This may be why they wish to exit their investment now through the sale to Kroger, since there is not much more room for operational improvements to add further value for them.

Growth

Albertsons has grown sales by 33% in nominal terms from 2017-2023, which is 7% in real terms (after inflation) with a CAGR of 1.1%. In the same period rival Kroger grew sales by 29% vs inflation of 24% for a real growth of 5% total, or 0.8% CAGR.

If we assume that going forward, Albertsons will only be able to match the growth rate of Kroger, then we assume a 0.8% real CAGR in sales. Given that Albertsons has already exceeded Kroger’s 10 year average profitability, it is unlikely that profitability will improve further. Therefore, I expect real terms growth in sales and earnings to be just under 1% for Albertsons going forward (i.e. nominal growth of inflation plus ~1% is expected).

This compares with a US real GDP CAGR growth of 2.4% in the 2016-2022 period, so these grocery stores are growing more slowly than the overall economy. There is not much scope for growth from new store openings, since the US grocery market is mature and fairly saturated. This can be seen as Albertsons only increased their total stores by 2% total in this 6 year period.

Capital allocation

In FY 2021-2023, Albertsons has allocated about 50% of operating cash flow to capital expenditure, and about 50% to dividends - including the $6.85 special dividend mentioned above. In the 2019-20 period, operating cash flow was used for paying off debt and capex, again in roughly a 50:50 ratio.

Appraisal

Free cash flow plus growth.

Albertsons has owner earnings of $1.63B vs the current market cap of $11.625B, this is a owner earnings yield of 14%, plus the growth of 1%, for a total potential return of 15%. If we assume that the market has a typical yield of 10%, then Albertsons at full value would be worth about $16.3B, for a (16.3-11.7)/16.3 = 28% margin of safety at the current price. However, this does not consider the long term debt of around $7B, or four years of current free cash flow - which would cancel out this margin of safety. Therefore, the opportunity cost of investing in Albertsons should be considered compared to where else that potential rate of return could be achieved, possibly in a less leveraged company.

Furthermore, the company is already as profitable as I think it can be, compared to its industry peer Kroger, and sales growth is likely to be very low in real terms, due to large size of Albertsons. Therefore, since real sales growth is only about 1%, you could consider the company like a bond paying a 14% real yield that will not grow much over time (but should keep up with inflation). However, in order to hit these numbers everything has to go right and management has to keep executing as they have been.

The potential catalysts here are twofold.

Takeover deal with Kroger: if this goes through, Albertsons shareholders will realise approximately a 33% return in about 1 year, if the takeover is not delayed by antitrust regulator negotiation or legal issues.

Private equity owners looking to sell: Cerberus are aiming to realise their investment in Albertsons, so if this deal falls through they will likely seek another one in order to sell their stake in the company. Due to the large nature of the stake in dollar terms, and the price that Cerberus will be looking to sell at, i.e. fully valued with all possible operational improvements having been made, it is unlikely that another private equity company would purchase it, so selling to an industry player such as a grocery chain, is the most likely outcome here. Cerberus are a motivated seller here: looking to realise their investment having successfully completed the turnaround of Albertsons.

Disclaimer: the Real Worth Stocks model portfolio does not hold a position in Albertsons (ACI). For full terms and conditions, please consult the Real Worth Stocks website at www.realworthstocks.com.