Alpha Group International (ALPH): >30% growth CAGR at a 14x P/E multiple, in takeover discussions

Business model, competitors, earnings quality, risks, and appraisal

Alpha International (ALPH), has grown at a 45% revenue CAGR since founding in 2009, and 31% revenue CAGR in the last 5 years: yet is only valued at 14x P/E - with a potential takeover from Corpay (CPAY) currently being discussed.

Alpha rejected an all-cash offer from Corpay (CPAY - listed on NYSE) on 5th May 2025, and is currently in discussions with Corpay about a possible revised offer.

It has grown organically since founding, to make 2024 profits of £123M/$168M, and yet is priced at just 14x earnings, despite growing at a CAGR of 31% in the last 5 years.

Investment Thesis:

Alpha Group International (ALPH) listed on the London Stock Exchange (LSE) is a fintech providing foreign exchange hedging and foreign bank account and payment facilities for corporations, institutions and alternative investment managers and companies which service them. It was founded in 2010, and earns a 30% return on invested capital. It is very cash generative, has 15% of the market cap in net cash on the balance sheet, and is priced at just 15x owner earnings (or 13x owner earnings after deducting net cash), with a very long potential runway for growth. However, it is currently priced as if it will deliver just a market-type return. Growth over the last 5 years has required no net additional working capital, so the growth finances itself.

Since the initial offer was rejected on 5th May 2025, indicated by the red arrow on the chart below, the stock has only moved up about 10% or so, indicating a low downside risk, should the takeover not happen. Corpay have until 7th July 2025 to make an offer or walk away - although this deadline can be extended if Alpha agrees.

Business Model

Alpha Group is a UK-listed fintech company, who have two main divisions:

FX risk management: managing foreign exchange risk for small and medium enterprise corporations, (48% of revenue), and for institutions such as pension funds etc. (22% of revenue). It earns revenue by charging commission on foreign exchange products such as forward currency contracts, option contracts, fx spot transactions, etc, and receipt of interest on client balances. This was the original division of the company when it was started in 2010, and when it has its IPO in 2017.

Alternative Banking: giving clients international payments and accounts through a service called Alpha Pay (30% of revenue). It earns revenue by charging fees on payments, and account maintenance fees, and receipt of interest on client cash balances. This division was started in 2020.

A third very small division acquired in Dec-23 is Cobase, a cloud based software which connects company’s various bank accounts in one interface (<1% of revenue). It earns revenue on SaaS (software as a service) fees.

Alpha split their earnings into, ‘underlying,’ and, ‘non-underlying,’ - the difference is that the non-underlying includes cash from client balances. After the steep rise in interest rates in 2022, interest on client balances went from ~25% of profit in 2022 to ~75% of profit in 2023 - see the grey part of the graphic below which shows this.

The former CEO until 2024, and founder Morgan Tillbrook is the single largest shareholder at 12% of the company (after recently gifting 1.64% of the company to the senior management team and his successor Clive Kahn) and has created a strong culture that the company does not attempt to predict the direction of the currency markets, but instead offers clients simple solutions to hedging their foreign exchange risks. He is stepping down as CEO at the end of 2024, and the current chair, Clive Kahn is taking over as CEO. He has committed to keeping his shareholding at a minimum of 10% for the next 3 years.

Alpha’s business model is to provide, ‘speed, responsiveness and reliability,’ to their clients, whether corporates or institutions seeking to limit their foreign currency risks, or else institutions who do alternative investment (e.g. private equity, etc.) who need to manage bank accounts and transactions in multiple currencies across the world in order to manage their investments. Alpha thinks that these customers are underserved by traditional banks: who use legacy systems, and are slow to open and operate accounts, and have generalised products, not specialised for the alternative investment market.

Competition and Market

Alpha operates in two main markets:

Providing FX hedging products for companies wishing to hedge their foreign currency exposure

FX hedging, plus alternative banking products for alternative investment managers/corporate service providers to them, to make payments and operate multiple foreign currency accounts, plus treasury management services.

Foreign exchange hedging market: Alpha state that 80% of the foreign exchange regulated market is banks, and 20% non-bank foreign exchange brokers. Banks typically offer generic advice on hedging - which is typically a small part of their business. The specialist foreign exchange brokers often offer more tailored advice, but Alpha asserts that they often sell their clients products that are more complex than needed, including ones that allow the companies to speculate on the direction of forex markets, aiming to profit on currency movements, rather than just hedge their cash flows to ensure that they neither lose or gain when exchange rates change.

Alternative Banking: Alpha’s customers are alternative investment managers and the corporate service providers and fund administrators that support them. Fund types are private equity, private debt, venture capital, real estate, infrastructure, and fund of funds. Their competition for this is almost exclusively banks. However, banks are typically built with legacy systems, focussed on a more general offering, and are slow to open accounts, and sometimes close them if they cannot earn enough profit from them.

Alpha state that there is therefore a gap in the market for a competitor such as themselves which can offer an easier, more responsible and reliable service. This claim is substantiated by the fact that they have grown their alternative banking business from zero when founded in 2020, to a 2023 revenue of £34M, at a 33% margin, with a 50% growth in customer accounts in 2023 to ~6500.

The table below shows key metrics for Alpha vs a one competitor; Record Financial (UK) and one company with some industry overlaps: StoneX (US) - both non-bank corporations. Alpha do not operate in the US where StoneX is located.

*Alpha Group revenue CAGR in table above is over 9 years, vs 10 years for the other companies.

Alpha, founded in 2010, is a much younger business than the other two, and has grown very fast. The revenue CAGR over the last 10 years is 49%, the last 5 years 37%, and 3 years 32%. Record Financial describes itself as, ‘A specialist currency and asset manager offering best-in-class products to large global investors,’ and was founded in 1983. It specialises in currency management for international clients, having $101B in assets under management in 2023. It uses a mixture of passive and active currency overlay strategies for investment managers. Active ones seek to profit from currency movement, by predicting the direction of the currency markets, and passive ones just to prevent gains or losses when investing in a different currency. This is a total contrast to Alpha Group: who specifically rule out trying to predict the direction of the currency markets (using active strategies) and are very critical of this. Their 2023 annual report states,

‘We know that nobody can reliably predict the currency market…we don’t consider ourselves, or position ourselves, as FX market experts, therefore… we have never published market commentary, news or forecasts. In fact, we don’t believe the notion of an FX market expert even exists or carries any legitimacy at all.’

So we can see that: Alpha has a very clear and strongly stated philosophy and culture, that is not possible to predict the currency market: implements this by not forecasting it publicly, will not sell products which speculate on foreign currency movements, and believes that there cannot be ‘experts,’ in this area. This is a clear point of differentiation with their competitors.

StoneX is a US based global financial services company offering global payments, risk management and hedging, exchange traded and OTC product execution and clearing, and various other products. However, margins are small at 0.5%-2% over the last 10 years vs >30% for Alpha and Record; as only part of their business activities overlap.

In summary, Alpha is priced lower in terms of price: free cash flow, and has much stronger growth, and a better return on invested capital than these two non-bank competitors. Banks have not been included in this comparison, because foreign exchange hedging is only a very small part of their business typically, so their overall financial metrics do not give an accurate picture of their foreign exchange business, and so it is not a fair comparison.

One of their competitors Argentex (AGFX) recently nearly went bust and was taken over for just £3M/$5M. Their share price chart below tells the tale.

Argentex offered their customers, ‘zero-zero,’ credit lines, i.e. zero initial and zero variation margin requirements. This means that when a customer’s trade moves against them, Argentex must post margin against it. In the chaos surrounding the Trump tariff announcements in early April 2025, with swings in major currencies, Argentex was forced to post margin to cover its customers deteriorating positions, and ran out of cash, and was forced into a sale for a pittance.

Alpha does not offer zero-zero credit lines, and hedges its foreign currency exposure, so this will not happen to Alpha.

Capital Structure

Alpha Group has a capital structure with net cash and no debt, and their stated policy is to continue this to maintain a strong liquidity position. Alpha’s CEO Morgan Tillbrook currently owns about 14% of the company: and although he is resigning effective end of 2024, has promised to hold a minimum 10% shareholding for the next three years. The CEO designate Clive Kahn has wealth from selling other payments business, has promised to substantially increase his stake, currently under 2%, and is buying shares periodically in the open market.

Alpha incentivise their staff in the various geographical offices in an interesting way. For example, when a new office is set up, e.g. the Canada office, Alpha will set up a subsidiary company for that office, and the staff will have performance related share options to potentially own up to 25% of it, depending on meeting revenue and profit targets. Alpha owns the remaining 75% outright. Then, if revenue targets are met - they are typically 20% growth per year - the staff get the right to have their options converted into Alpha shares: and in return Alpha gets back the ownership of that part of the subsidiary. If targets are not met, the options expire, and Alpha gets back the ownership without having to give shares to the employees. The CEO of Alpha has an employee ownership philosophy, because he wants the employees to have a stake in the business and be incentivised to grow it.

Capital Allocation

Reinvestment in the business: Alpha allocates most of its free cash flow by reinvesting in the business for organic growth, and has just completed opening various offices around the world in key jurisdictions, except the US. It has achieved a 10-year average return on invested capital of 25%, so this is a good choice. The strategy stated in the 2023 annual report is to invest now more in front office staff in these offices, to drive increased sales and new customer acquisition.

Dividends: Alpha has a progressive dividend policy: but in 2023 yielded about 0.75%, so is paying out 7% of net profit in dividends: so fairly minimal. Over the last 7 years it has paid out only about £22M in dividends, of £238M in accounting profits: so about 11% of earnings.

Share buybacks: Alpha authorised a £20M share buyback in 2023, which is 20% of net profits.

Retained earnings: Alpha considers it important to have a strong balance sheet to inspire confidence with its counterparties, and provide funds for organic growth, so it keeps a net cash position. The majority of earnings are retained - but Alpha does not need all of it’s retained earnings. It will be interesting to see what is done with these.

Acquisitions: Alpha made it’s first ever acquisition in 2023, of 86% of Cobase (a SaaS treasury management software company) for £8.6M plus additional consideration earn out to buy the remaining 14%, over 2025-2028 - so this is not a big part of their capital allocation strategy.

The CEO states that they are often shown opportunities to buy competitors in the foreign exchange regulated market space (companies that provide a marketplace to buy and sell foreign exchange products): but do not complement Alpha’s culture and do not add value to the business.

Durability, Quality & Risks

The durability of Alpha’s business depends on the overall economic environment, and their ability to continue to capture business from corporations and institutions: for both alternative banking; making international payments and having international bank accounts, and also foreign exchange hedging; hedging their currency risks by buying foreign exchange hedging products.

Approach to customers: Relative to it’s competitor Record Financial and other competitors: Alpha does not seek to make currency profits for it’s customers by speculating on the direction of the currency markets. This means that it is less likely to disappoint its customers in making losses - active speculation will inevitably sometimes lead to losses for customers, causing them to withdraw their business - so this approach ultimately damages customer retention, and reputation in the marketplace. For instance, after the 2007-2008 financial crisis, Record Financial lost business as customers stopped using active overlay strategies to try to profit from currency movements.

Customer retention: Alpha takes an approach to its customers, that focusses on acquisition of new customers, more than increasing business with current customers. Staff are incentivised to sell simple rather than complex hedging products to customers, by Alpha setting lower rates of commission on the more complex hedging products, and higher rates on the simple ones. This culture is driven by the founder CEO who strongly believes in this approach. Further: no revenue targets for existing customers are set, to avoid incentivising Alpha to sell them products that they don’t need. This long-term thinking approach to build customer relationships and trusts is distinctive in the industry. As Charlie Munger said, ‘Show me the incentives, and I will show you the outcome.’

Quality of earnings:

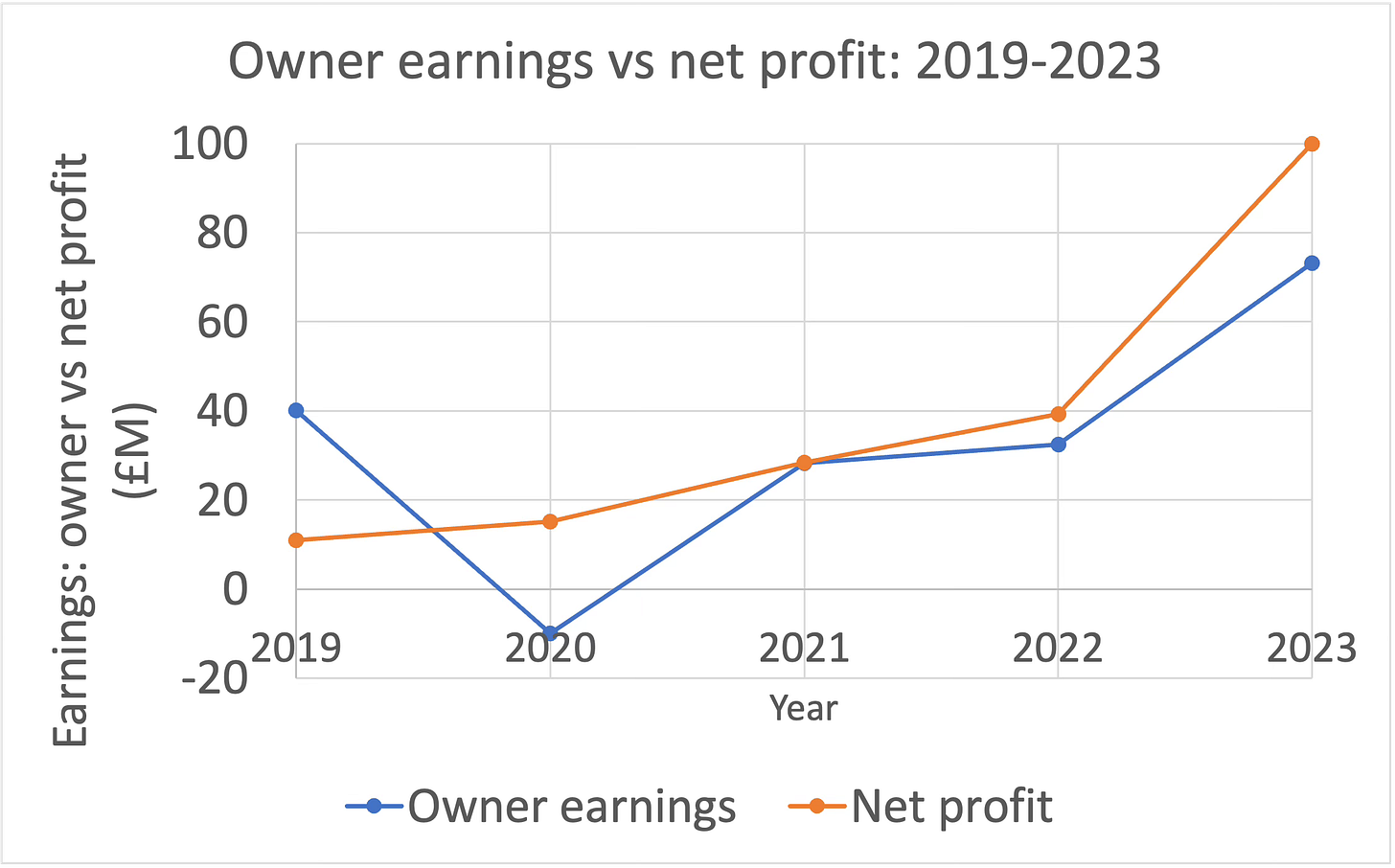

The graph below shows owner earnings that I calculated (net profit after tax, plus all non-cash expenses such as depreciation and amortisation, i

ncluding for leases, minus all real expenses, e.g. capex, acquisitions, lease payments and taxes.) The swings of owner earnings above and below net profits in 2019-2020 are due to the timings of working capital movements.

Alpha Financial: owner earnings vs net profit:

Net working capital movements: when these are summed over 2019-2023 it is just an increase of just £0.5M - i.e. pretty much zero: which shows that over time, the business does not need any working capital to grow. This is excellent, because it means that the business can scale without absorbing working capital: which means earnings can be redeployed in more fruitful ways for shareholders. Net profits pull ahead of owner earnings in 2022 and 2023 due to increased spending on capex, and also the acquisition of Cobase in 2023.

Since owner earnings are calculated after all capex spending and acquisition spending is deducted, the figures represent the truly free cash flow, that can be extracted from the business, after all these investments to maintain and grow the business have been made.

It can be seen that the business is extremely cash generative: this is because it only requires some leased office space, IT systems and some software, and personnel to operate - all of which scale with revenues and do not require fixed upfront investments.

Therefore, the quality of earnings is fairly high.

Sources of earnings:

Alpha earns money in two main ways:

Underlying business (commissions on foreign exchange products, fees for opening and operating foreign currency bank accounts, and making foreign currency payments)

Interest on client balances. Under the terms of Alpha’s electronic money licence from the UK financial regulator the FCA, it is prohibited from paying interest earned on client balances, to the clients: as it is licenced as a payment service, not a bank.

The underlying business has been discussed above: but interest on client balances depends on interest rates which are set by central banks, and are totally outside Alpha’s control. When rates were hiked fast in 2022 around the world, Alpha’s earnings from interest on client balances increased hugely to become 75% of profits. This can be seen by comparing underlying earnings (excluding interest on client balances) for 2023 of £43M in the graphic below, with profit before tax of £115M in 2023, which includes interest on client balances.

Therefore, the quality of these earnings is much lower and will be more variable. However, they can be predicted depending on the client balances, which have been growing rapidly over time. Alpha also hedged these at 3% for a period of time which has now expired.

I count these earnings as part of Alpha’s earnings, as I think that it is very unlikely that interest rates will return to the all-time lows seen in the last decade up to 2022, and the trend of growing client balances will continue, so even if interest rates are cut to 2-3%, I would expect Alpha to continue to earn interest on client balances at roughly the current levels, or increasing levels over time - because of the volume of client balances is increasing over time.

The graph below shows where earnings come from for Alpha, and the margins for the two main divisions, and the businesses within them. Most of the corporate business is in the UK.

Risks:

The disruptor being disrupted:

Alpha Group is a disruptor in the markets that it operates in: of course disruptors may themselves be disrupted. I view the biggest risk to their business as being a well-funded competitor, attracted by the high returns in their industry, essentially copying their business model, and reducing the margins that they can earn on their business.

Offset against that are two factors:

First mover advantage and customer stickiness: the services that they provide: particularly the alternative banking services, should have high customer retention rates. These are mission critical services, akin to a core processor software provider that provides the backend software for banks to operate their systems, and are highly complex to replicate: so once the have gained customers in alternative banking, I think that Alpha is unlikely to lose them. The foreign exchange hedging customers are likely to be less sticky, as these services are easier to duplicate elsewhere.

Valuation of the business: see the appraisal section at the end. The current valuation almost totally discounts any growth in the business, as there is an owner earnings yield of 8% - see the appraisal for details of this - similar to a market-type return. Since it would take time for a fintech competitor to enter the business and build up relationships of trust with the customers, there would be plenty of warning of this in advance. Even if growth slows as a consequence, the existing business is sufficient to support the current valuation, so I see little downside risk from this at the current price.

The CEO Morgan Tillbrook is leaving the business at the end of 2024. However, Clive Kahn who is taking over has been with the business as non-exec chair for a number of years, and inherits a strong culture, and also has a lot of industry experience, so while not ideal, I am not very concerned about this.

Growth

There are two main divisions in Alpha:

Foreign exchange hedging (currency risk management for institutions and corporates): grew by 10% in 2023.

Alternative Banking: (global payments, and foreign currency accounts for alternative investment managers and the companies who service them): grew by 18% in 2023.

Foreign exchange hedging: this is the business that Alpha started with in 2010, and it represents 69% of revenues in 2023.

Alternative Banking, started in 2020, now represents 31% of revenues. Given it’s structural advantage over banks, in that it is a specialist provider focussed on alternative fund managers, that are served poorly by banks, I would expect to see it continue to take share in its market over time.

Overall: Alpha has grown top line revenue at a CAGR of 45% over the past 9 years: however it still only has a <1% share of the £200B worldwide foreign exchange regulated market.

The graph below shows where the Alpha earnings come from and how they grew in 2023.

Environmental, Social and Governance Factors:

Environment:

Alpha has a minimal environment impact, because it does not manufacture any products. In their carbon emissions breakdown, the vast majority of emissions comes from employee travel: as they have been setting up offices around the world requiring staff travel.

Social:

Alpha does not have any issues with trade unions and there are no mention of these in the annual report. They do have a high performance culture and their staff work long hours, but has very favourable impressions of the company on Glassdoor.

Governance:

Key audit matters in the last audit were:

Existence and accuracy of revenue - this was verified.

Accounting for growth share schemes - this required the previous year’s financial statements to be restated, but this was done and the restated financials have been judged acceptable. There was an accounting issue of a mistake being made around the accounting of share based payments for growth share schemes, which was a key audit matter. This has now been rectified, and also the accounting treatment of share based payments changed which had the effect of increasing earnings. in 2023, the size of the internal audit team was also increased at Alpha - this function was created in 2022.

Appropriateness of Credit value adjustments (CVA) - identified in 2022, and no longer considered to be a key audit matter in 2023 after evaluation

Fair value of growth shares - identified in 2022, and no longer considered to be a key audit matter in 2023 after evaluation

A new chair has been appointed: Dame Jayne-Anne Gadhia. She is a chartered accountant, and helped found Virgin Direct in 1995, setting up the Virgin One ccount, then was CEO of Virgin Money for 10 years, leading it to IPO. She then set up her own fintech called Snoop, sold it to Vanquis Bank in 2023. She is a lead non-exec director at HM Revenue and Customs in the UK.

Overall, given the failure to detect internally the share accounting issues, I would say that the governance needs to be improved, specifically their accounting and internal audit functions. With the establishment of the internal audit team in 2022, this has been addressed: and is a matter that I will pay close attention to going forward.

Appraisal

1. Free cash flow plus growth.

Free cash flow for Alpha was determined by calculating owner earnings as described in the section on earnings quality. Owner earnings were calculated as £88M in 2024, after all capex and acquisitions had been deducted: so any growth seen in the company has been fully paid for. This is an owner earnings yield of £88M owner earnings / £1336M market cap = 7% owner earnings yield. If we invert this ratio, we get a price:owner earnings of £1336M/£88M = 15x. Revenue growth has averaged 45% CAGR over 10 years, 37% CAGR over 5 years, and 32% CAGR over 3 years. If we conservatively assume a 14% growth rate - which is about the rate of growth in the underlying business in 2023, this would be a return of 7% owner earnings plus 14% growth, for a total return of 21%. Given the current small size of Alpha relative to the markets it operates in, there is a very long potential runway for growth. In addition, they have just purchased Cobase, and also started a fund finance business, which could contribute to growth when they become large enough to be significant to revenue.

If we look at the return of ALPH stock since IPO in 2017, it launched at 196p and is currently trading at 3080p, for a CAGR of 41%: a little above the revenue growth of 33% CAGR in this period.

In addition, there is the potential catalyst of the takeover discussions with Corpay (CPAY)

Disclaimer: this is not investment advice, and is for informational purposes only. While every effort has been made to ensure that the information contained within is accurate, no guarantee is given as to the accuracy of the information, or its suitability for any purpose

Disclosure: the Real Worth Stocks model portfolio holds a long position in Alpha Group International (ALPH) at the time of writing.

Very nice report! Thank you so much.