ASML thoughts

'Picks and shovels' provider to the global semiconductor industry, or cyclically overpriced?

A member recently asked me to look at ASML, a supplier to the semiconductor industry, for her. (For new members, I will offer a look at any one stock they are interested in, additional to the monthly stock picks.) Now onto AMSL…

Who are ASML?

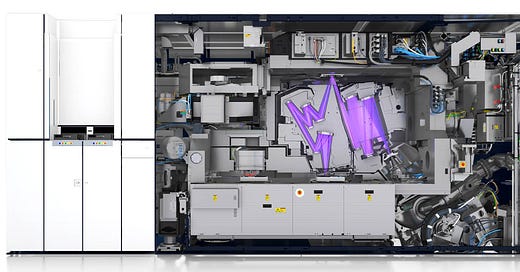

AMSL manufacture extreme ultra-violet (EUV) lithography machines for making semiconductor chips - so they don’t make chips: but sell these machines to customers such as Intel, who do. ASML pioneered the EUV technology, that at one time was considered impossible, and continue to push the boundaries of what is possible in chipmaking. Essentially, their machines are the technical and market-leading solution for making the very small patterns on chips, that are allowing companies to keep following Moore’s Law, by packing billions of transistors onto chips.

Schematic of one of the ASML extreme ultra-violet machines for chip lithography: purple colour shows the beam path of the extreme ultra-violet light.

Pros of AMSL

The business quality looks excellent: they have a near-monopoly on the latest generation of extreme ultra-violet machines for making the latest generation of chips – these machines allow the creation of the <10 nm features which are used in the latest chips. This allows them to set high prices for their products, since their equipment is not easily substituted, and the chips are critical for many products from cars to routers to computers to tools. In addition, the cost of the ASML machines are a very small part of the cost of the chips, so ASML’s customers are likely to be relatively insensitive to price. Demand for the chips, and therefore the machines, is likely the main driver of profits rather than the price of their products.

The demand for chips looks robust into the future, and is likely to keeping growing, and they are well-placed to benefit from this. You could consider them like a ‘Picks and Shovels,’ type investment.

It has been noted that the companies that made the most money in the California gold rush in the 1840s were not the gold miners, but those who sold the picks and shovels to the gold-crazed miners. Rather than a speculative search for gold, selling picks and shovels was the sure thing. In a similar vein: ASML does not make microchips, but provides the tools to the semiconductor industry to do so - tools that are superior to those of their competitors. However, the market is aware of this and so the stock is not cheap…

Cons of ASML

Current valuation:

Return in a stock can come from one of two sources: P/E multiple expansion, or growth in earnings of the business from revenue, and/or profitability increases. Let’s look at where the return came from over the last 10 years with ASML, and where it could come from in the future:

Oct-14: Stock price: $99, and P/E ratio: 31x. Operating margin 21%. Operating profit in 2014: $1.4B

Dec-24: Stock price: $688, and P/E ratio 38x. Operating margin 33%. Operating profit in 23/24: $8.8B

Total return in the ASML stock price is 22% CAGR. Operating profit compound annual growth rate is 20%. The difference between these can be accounted for via the increase in the P/E multiple.

If the operating margin had remained constant, instead of increasing from 21% to 33%, then earnings in 2023/24 would have been 8.8*21/33 = $5.6B. If this was the case, then the CAGR in operating earnings would have been 15%.

Therefore, we can divide the return into various factors:

15%: growth in revenue

5%: growth in profitability (improvement in operating margins from 21% to 33%)

2%: increase in the P/E multiple from 31x to 38x

Sum: 22% annualised return in the stock from 2014-2024.

For each factor, we can now consider what could happen in future for them:

Revenue growth: the 10 year CAGR for revenue over the last 10 years is 15%. During this period, there has been a boom in semiconductors due to AI – but actually, ASML makes most of it’s revenue from non-AI semiconductors – it’s primary customers are TMSC, Intel and Samsung. Therefore, the 15% growth rate can only continue if there continues to be the same continual demand increase for the company’s machines to make semiconductors. It is almost certain that semiconductor demand will continue to increase, but is it hard to say whether it will increase more or less than 15% CAGR. The overall semiconductor market is forecast to increase with a CAGR of 7% according to McKinsey. However, ASML is likely to have increased demand of more than 7%, but I would think less than 15%.

Growth in profitability: it is possible that profitability (profit margins) could grow further given the strong competitive position for the company. However, profitability is also geared to the percentage of their manufacturing capacity that is being used. Therefore, if there is a slowdown in revenue, this could negatively affect both their margins and profitability if their factories are underutilised - this is operating leverage in reverse.

Increase in P/E multiple for the company: it is already pretty high: at 38x. If there is a slowdown in growth, this could decrease.

Reliance on R&D and technical innovation. ASML is able to make high margins and charge high prices as it is at the cutting edge of technology. There is a risk that another company could become a serious challenger to ASML, eroding it’s competitive position. While this is unlikely in the next 5 years: it could happen longer term and this would negatively affect their share price.

There are high expectations for growth implicit in the current share price (after the fall). Therefore, the future direction of the share price is highly leveraged to the demand for their products. A small decrease to the demand forecast could lead to a big drop in the share price – which was seen recently - it peaked over $1080 in July 2024. At the time of publication the stock price of AMSL was $688.

Summary

In summary, personally I cannot recommend ASML for investment at the current price, because the downside risk is too high because of the high growth expectations baked into the current price. However, as a long term holding, it is likely to perform well given its strong position in the chip market, and it is one to watch. If there is a big economic slowdown, then it could be a great buy if the share price falls a lot further. For example, if the US goes into recession: chipmakers will greatly reduce their purchases of ASML’s machines, and so earnings will plummet, and the share price would also. After a price crash, 1-2 quarters into a recession might be a great time to buy the stock. Of course, demand for chips may stay strong for a while and the stock will may do well - but for me at the moment, there is too much downside risk to invest.

To learn what stocks I do consider good investments at this time, you can try our latest members-only stock pick for free below:

Fintech disrupting their industry, growing, with net cash, at <10x P/E

This stock pick has grown organically since founding, to make 2023 profits over £110M/$140M, and yet is priced at just 10x earnings, despite growing at 15% in the last year, and with a CAGR of 49% in revenue over the last 10 years. Read on to discover why I think that the stock is underrated by the market.

Disclosure: Real Worth Stocks does not have any position in ASML

Disclaimer: While every effort has been made to ensure the accuracy of information provided in this post, no guarantee is given as to its accuracy. This is not investment advice, and is informational only.