Growing telecoms company with 90% recurring revenue at 13x P/E, and >20% ROIC

Share price at a 6 year low may be a good entry point

Investment Thesis:

Gamma Communications (GAMA) is a business communications software services provider, trading at 13x earnings, growing 5%-10%/year, with 90% recurring revenue. It has ROIC and ROE of 24%, and has just made a significant acquisition in the German market, which is growing at a CAGR of 15% 2025-2030. Due to promotion from AIM to the FTSE 250 in the UK, macro-economic fears about the UK and Germany, and most importantly, a slowdown in organic revenue growth to mid to high single digits, the stock has fallen 58% from its all time high in 2021, to a six year low. This is despite earnings being up 30% since 2021, creating an excellent entry point, and making downside risk low. Since the 2014 IPO, it has not been valued at this low a P/E by the market.

Business Model

Gamma has three divisions selling communications and software products:

Business: (64% revenue) selling to channel partners, who sell to SME customers

Enterprise (22% revenue) selling directly to large companies and the public sector

Europe: (14% revenue)* selling direct and through channel partners to Germany, and also the Netherlands and Spain. *not including recent acquisition of STARFACE in the German market.

Part of their business model is to turn, ‘product,’ from Microsoft and Cisco into cloud based ‘solutions,’ for their customers: packaged cloud services sold directly or to channel partners to organisations.

89% of revenue is recurring: and is made of two components:

Voice and data traffic (19% of revenue)

Subscriptions, rentals, and installation fees: (70% of revenue)

Non-recurring revenue products are equipment sales, commissions and installation fees: (11% of revenue)

Technologies/strategies that are used in their products are:

Unified Communications as a Service (UCaaS): bringing together various communication types, e.g. voice calls, video, WhatsApp, etc. in one cloud-based application.

Voice enablement: allowing Microsoft Teams to make and receive voice calls to phone numbers

VoIP (voice over internet protocol) services, through SIP trunks.

IoT (internet of things) enablement, to allow devices to communicate with the cloud without dedicated phone lines, e.g. for the AA in the UK

Expansion of product offering, and growth through acquisition:

Gamma have been buying companies to expand their product offering. Recent acquisitions include:

STARFACE in Feb 2025: about 500k cloud/hardware seats in Germany

Placetel in Sep 2024: 270k Cisco users

Coolwave: 2024: MS Teams voice enablement service for 20 countries

Brightcloud: 2024: Contact centre solutions

Satisnet: 2023: Cyber security services

Gamma’s company goals are:

Create a common pan-European solution for UCaaS: which their channel partners like, since it offers the ability to sell a broad range of products in many countries.

Rebuild their customer portals to integrate all their acquired products into one interface, for all routes to market (direct and channel), and have good customer service across all.

Replicate success in Enterprise division in the UK, in Germany

Integrate acquisitions and create a common culture of values and goals for people across the business (across Europe)

Competition and Market

Their main markets are the UK (57% cloud penetration) and Germany (20% cloud penetration). The German market is growing faster, with the market for cloud seats forecast to grow at 15% CAGR 2025-2030.

Competitive advantages: Gamma state that their competitive advantages are their ability to provide a complete set of solutions across multiple countries in Europe, with good customer service, citing customer experience surveys vs industry and telecoms benchmarks. They do however state that they want to relaunch a unified customer portal: this is a work in progress. Over time as they make acquisitions and broaden their offering, they are improving their competitive position.

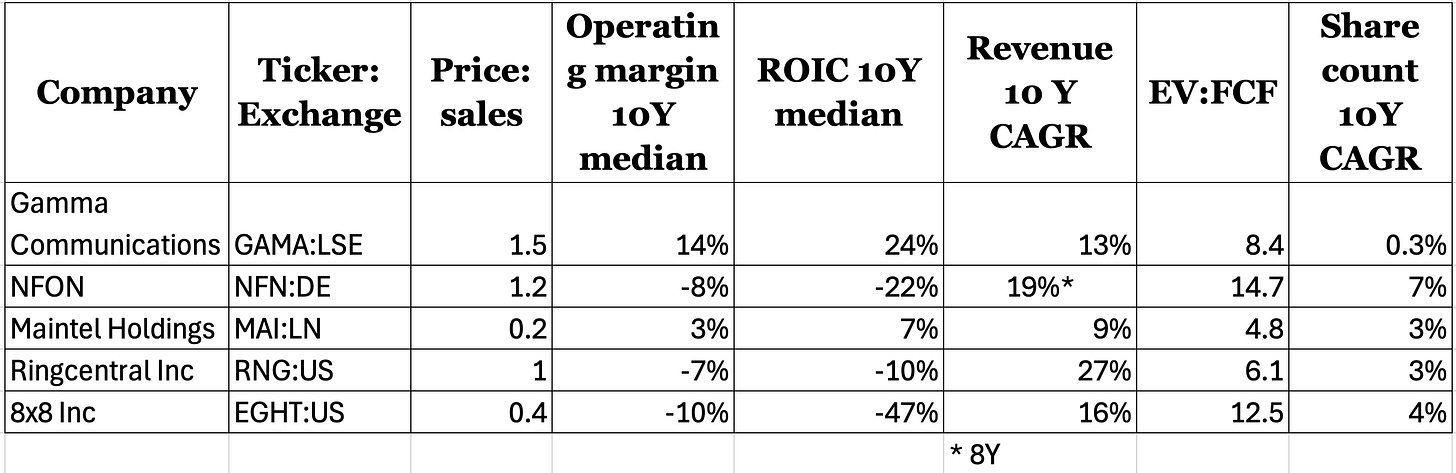

Competitors: the table below shows some direct competitors, e.g. NFON in the German market, Maintel in the UK market, and also comparable companies in the US.

NFON is a venture capital backed, money losing UCaaS company in Germany that directly competes with Gamma. It has just broken even for the first time after breakeven after eight years of losses, and has grown mostly organically: though it did issue shares and made one acquisition a few years ago. In the 2022-2023 period revenue growth slowed to 7% then 2% respectively.

Maintel Holdings is a slow growing UK listed company that is in most of the same product areas as Gamma, but is much less profitable, with negative retained earnings.

Ringcentral and 8x8 are large US-based comparators: but both have business in Europe so are also Gamma competitors. Ringcentral has a tie up with Vodafone. Both are prioritising growth over profitability, and make losses continually, though in both cases growth has been in the very low/negative single digits in the last couple of years vs teens double digit growth historically.

It is also notable that of all the companies examined, Gamma is the only one not growing it’s share count: all others are diluting by 3%+ a year.

In summary: Gamma is more profitable than its competitors, and is not diluting shareholders despite growing. This is reflected in the higher price:sales ratio vs competitors.

Capital Structure

Gamma Communications has a simple capital structure, with one class of shares outstanding, and no long term debt. They obtained a £130M revolving capital facility to buy STARFACE, but as of June 2025, it was only 1/3 drawn down, and the company net debt position was £22M: which is just 0.25x earnings, so their balance sheet is very strong.

Capital Allocation

Share buybacks (1/3-1/2 of earnings)

Gamma started share buybacks for the first time in 2024 with 1/3 of earnings, and increased this by 50% in 2025, almost completing this by June 2025.

Dividends (1/4 of earnings)

Gamma has a progressive dividend policy: with payments rising 10%-15% per year since IPO in 2014.

Acquisitions:

Gamma had £145M in cash on the balance sheet at year end 2024, but then acquired STARFACE in early 2025 for £164M using mostly existing cash reserves. It also established a £130M (1.4x EBITDA) revolving capital facility to finance the acquisition: which is only drawn down by £47M. Overall, it is in a small net debt position (0.25x earnings). Probably by FY 2025 end, this will be paid off in full if no more acquisitions are made. However, I expect to see continued smaller acquisitions as Gamma builds out its product offering, and management have stated that:

‘…we continue to seek additional acquisitions to improve our scale and market position in Germany…to expand both our connectivity offering in Germany, as well at the solution that we offer our service providers.’

Durability, Quality & Risks

Durability: Gamma signs multi-year contracts with its direct customers, and the nature of their business providing a communications service means that 90% of revenue is recurring. The business spends about 20% of operating profit on PP&E, most of which is on intangible assets such as software.

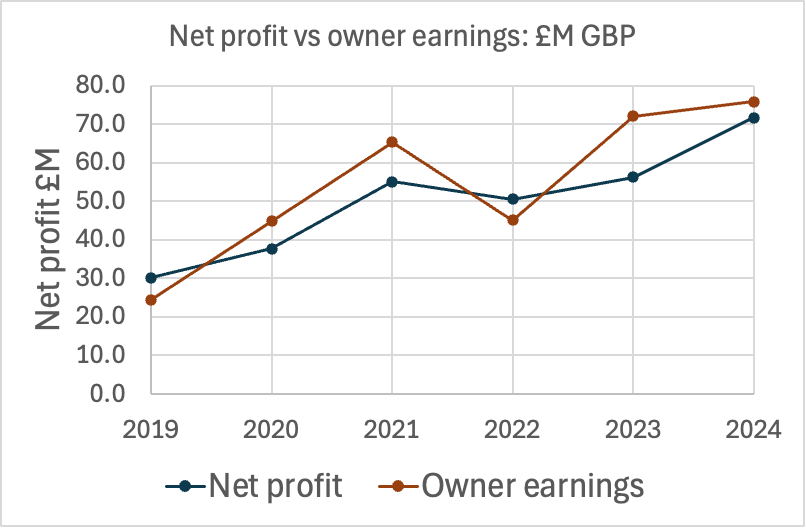

Earnings Quality: I have analysed owner earnings vs reported earnings: which is shown in the graph below. For 2019-2024, owner earnings is about 10% higher than profit. This is because less is spent on capex, than depreciation/ amortisation. In addition, the working capital increase during this period is only about 13% of total earnings in the period, so not much working capital is required in order to grow the business. This underpins owner earnings and means that a lot of cash is available for returns of capital through dividends, buybacks, and to finance growth through acquisition. Gamma also has an excellent return on invested capital and return on equity, both with a median of 24% over the last 10 years, though they both fell to about 20% since the pandemic.

Timing of cash flows: customers pay up front for subscriptions/rentals (70% of revenue), and in arrears for voice/data traffic for voice data traffic (20% of revenue). Therefore, not much working capital is needed to grow the business since the majority of revenue is recognised when the service is delivered, after the business has received the cash.

The biggest single cost by far is their employees, at over 50% of their operating expenses, which is a very predictable cost: and other significant costs such as product licences are predictable as well, so their margins are quite stable.

They are also in growing markets, with 57% cloud penetration in the UK and just 20% in Germany. Their ability to grow earnings in future will depend on three things:

a) ability to maintain margins in their product range

b) ability to meet their customer needs, as they evolve for various reasons, e.g. change due to AI.

c) overall UCaaS market growth

Quality of earnings:

Risks

Cyber Security:

Gamma is accredited to ISO 27001 (information security) and ISO 22301 (business continuity). Gamma do routine and bespoke penetration testing, with continuous compliance checking and integrated security training for all employees. They also purchased Satisnet, a cyber security company so this is part of their product range, and so they have internal expertise in this area.

Risk assessment by all, but risks owned by named people:

All employees are encouraged to consider and document risks, which are passed to the relevant risk owner and assessed with appropriate actions taken, and passed quarterly to the risk and audit committee.

The board owns the most significant risks: the ones which could have a material effect on the business.

Threat of AI: Gamma comments that the cost of new entrants using AI to outperform their product would be prohibitive. However, I am concerned that as their well-funded competitors integrate AI into their product ranges, that Gamma continues to spend enough on R&D each year: mostly on software. If they cannot keep innovating they may be left behind in this area. This plays into the next risk:

Slow responses to shifts in competitive landscape: Gamma mitigate this by constantly engaging in 2-way dialogue with customers, and also by M&A.

I think that the two risks above are probably the greatest risks to Gamma: technological shifts that could affect their profitability, and growth. Set against this is that customers typically sign multi-year contracts, and also that there is not a high rate of customer turnover. This is something that I will continue to monitor on an ongoing basis: by looking at margins, and how the number of cloud seats that the business holds changes over time.

Competition for staff in sales DevOps and IT Security: this risk relates to their profit margins: if they have to pay more for the right staff, this could lead to lower margins. This is not reflected in their margins at the moment however, which are stable.

Growth

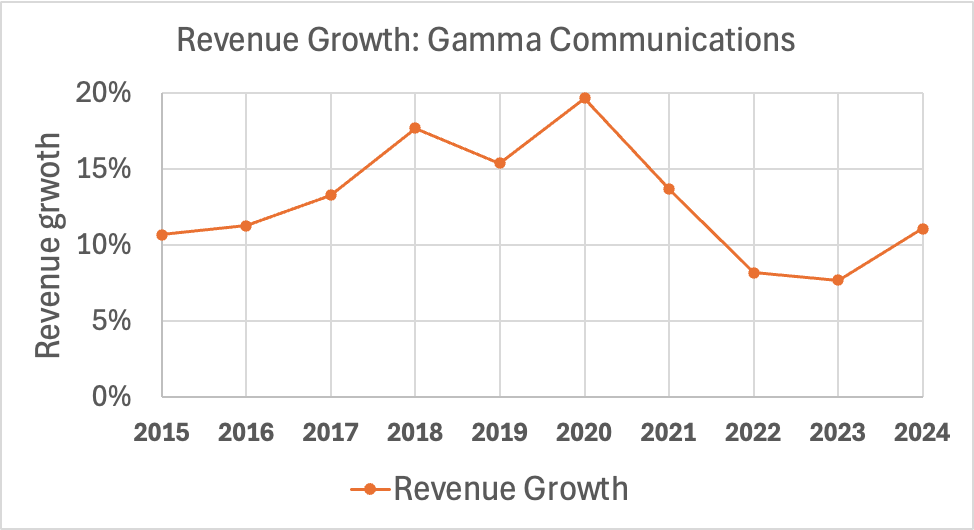

Total revenue growth at Gamma is charted below. Revenues grew strongly up to and during the pandemic, then dropped off. I think that the drop off is due to:

- pulling forward of demand for conversion to cloud services due to remote working requirements in the pandemic, so there is lower demand afterwards

- the macroeconomic slowdown in 2022-2023

- reductions in remote working reducing demand for new UCaaS licences, as remote workers returned to the office to work hybrid

All of these factors led to slower growth for most UCaaS companies since the pandemic, which in turn led to their share prices declining significantly, including Gamma’s. The peak in share price was reached in August 2021, at around £23/share, and it has now declined to £10/share.

Organic growth for Gamma in 2024 was 5%, and inorganic growth was 6% for a total of 11%. Inorganic growth includes the Placetel, Brightcloud, Satisnet, and Coolwave acquisitions, but this does not include any growth from STARFACE in Germany, since this was purchased in Feb-25, after the FY24 year end.

Germany now represents 20% of total revenues, and there is a 15% CAGR forecast in cloud seats in Germany over the next 5 years for the market. 43% of the UK market, and 80% of the German market still do not use cloud services, so there is significant room to grow. In addition, many of the German customers of STARFACE are using a hardware PBX communications system. If Gamma can switch them over to the cloud, they could double ARPU (average revenue per user) if switching to MS Teams, or even more if UCaaS offering: so they have an opportunity to upsell existing customers.

Prior to the pandemic, Gamma grew at 11%-20% a year, and in 2022-23, at 8% each year. In the case of Gamma Communications, we can conservatively assume that organic growth rate of 5% seen in 2024 will be the same going forward: which is less than the rate of 8% in 2022 and 2023.

Environmental, Social and Governance Factors:

Environment:

Gamma has committed to reduce scope 1 and 2 emissions by 90% by 2030, and be a net zero company by 2042, and is currently in the process of creating a costed plan to achieve this according to the Transition Plan Taskforce (TPT) methodology. TPT guidelines were launched by the UK Treasury department in 2022. More than 90% of Gamma’s emissions are scope 3: coming from its use of purchased goods and services, principally cloud computing services.

Social:

Gamma cited responses to their employee feedback survey: where employees requested:

- better alignment of quarterly top management roadshow meetings to the company strategic pillars and values

- improved visibility of internal vacancies

- greater focus on training and development

Gamma has, ‘YouBelong,’ groups to meet and discuss topics and suggest ways the company can improve their experience. The citation of employee survey results, etc. in the annual report, suggests that the company is actively seeking feedback from their employees and is listening to them. Glassdoor reviews of working at Gamma give an overall rating of 3.4, with a 68% approval rating for the CEO.

Unions are not mentioned in the 2024 Gamma Annual report: and there is no indication that workers are unionised or collective bargaining arrangements are in place.

Governance:

As Gamma integrates acquisitions and moves to the UK main market (in May 2025), they are making governance more systematic and consistent: e.g.

- Adopting the UK Corporate Governance Code

- in 2023, they have implemented one integrated management system for all ISO standards they are accredited to

- formation of an M&A committee in 2024 to ensure all M&A opportunities went through a consistent vetting process

External audit: The auditor Deloitte found no issues: the following matters were identified as key audit matters:

The accuracy of Gamma business usage revenues, and reporting controls.

Carrying value of goodwill in their Netherlands subsidiary, which is experiencing slower growth.

Valuation of the consideration to buy Placetel: which also involved entering into a 5 year contract to buy Cisco services.

Board:

CEO Andrew Belshaw is a chartered accountant, with Gamma since 2007, and CEO since 2023: before that he held various financial positions within Gamma, culminating in being CFO: so he has a lot of financial experience, but not in other areas.

The CFO Bill Castell was previously CFO at Ovo Energy and Virgin Media, so he had prior telecoms experience. He is an accountant, and was previously a Deloitte auditor and investment banker with Goldman Sachs. He is on the board of the UK Financial Ombudsman Service, a public body that handles consumer complaints, which is helpful as it probably gives him a close connection to the UK consumer to understand their issues with the products and companies in the UK financial sector: which is helpful for his customer focus.

The chair of the board Martin Hellawell is a veteran of ComputaCentre, and SoftCat, leading it to IPO in 2016. The company has continued to be successful to date. Softcat resells IT infrastructure solutions (cloud computing), and many associated IT services: so he is very experienced in the cloud computing world and no doubt has good connections.

The CTO Colin Lees was previously Chief Technology and Information officer at Openreach: the network business part of BT (British Telecom) so has significant telecoms and network experience.

Some other board members have M&A experience, e.g. Xavier Robert and Shaun Gregory, and an M&A committee was formed in 2024 to find and vet acquisition targets.

The board are not paid excessively: with the CEO having a possible total pay (base salary, bonus, pension, and value of options) award of £3M assuming a 50% share price appreciation, with a minimum pay of £0.5M. In 2024, the CEO and CFO took home about 3.5% of Gamma profits after tax, in a year where revenues grew 11%.

Appraisal

1. Free cash flow plus growth.

Owner earnings averaged over 2023-2024 are £74M. At the current market cap of £920M (share price 1000p), this is an owner earnings yield of 8%. Revenue CAGR has been conservatively estimated above at about 5%/year, for a total return of 13%/year. However, I expect that Gamma’s organic growth will be higher than this, because of the larger contribution from the fast growing German market: and because the German government is embarking on a massive rise in military spending due to the situation with Ukraine and Russia, which should help the German economy.

Given Gamma’s 90% recurring earnings, and rating of 13x P/E at the moment, which would be expected for lower quality companies than it, I think that there is limited downside. There is also the potential for a re-rating for the stock by the market, especially if earnings growth surprises to the upside. Given the highly cash generative nature of the business, and current low rating, there is also a small chance of a private equity takeover bid for the company.

Disclaimer: this is not investment advice, and is for informational purposes only.

Disclosure: the Real Worth Stocks model portfolio holds a long position in Gamma Communications (GAMA). At the time of writing, this was 8% of the portfolio, the 5th largest position.