Growth stocks crushed by rising interest rates and outlook for 2023

2022 was an eventful year in the stock market – big themes were growth stocks crushed by rising interest rates, and significant inflation.

Growth stocks correction: Many growth stocks that soared during the pandemic fell a lot, e.g. Microsoft -30%, Nvidia -51%, Netflix -52%, and Tesla -66%. At Real Worth Stocks, we focus on value stocks, net nets and merger arbitrage which are better protected in a market downturn. Looking ahead for 2023, recessions are expected for the UK and US, so this correction in growth stocks may continue.

Inflation: At the start of 2022, UK CPI inflation was 5.5% and in December reached 10.7%, and US inflation started and ended 2022 just over 7%. In both countries, inflation reached 40-year highs, so for 2023, I am considering the pricing power of stocks in the Real Worth Stocks portfolio to find stocks that are able to raise prices with inflation.

Rising Interest Rates

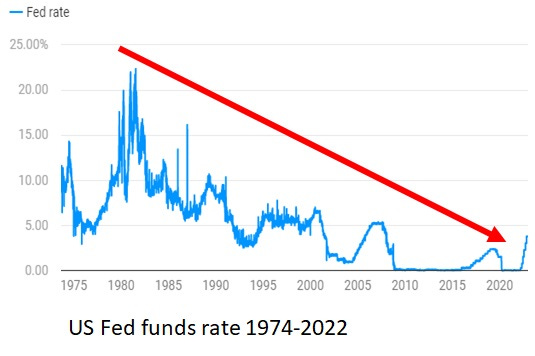

The response of the Bank of England in the UK, and the US Federal Reserve has been to raise interest rates from the historic lows seen in the last 10 years. In superinvestor Howard Marks’ memo, ‘Sea Change,’ he reflects on the role that falling interest rates have played in helping investing returns, since the peak in interest rates in the US and UK in the 1980s.

Central bank interest rates have been falling for the last 40 years: but now with inflation picking up, they are rising as you can see below.

For investors, this means that the era of cheap debt is over: with UK interest rates now at 3.5% and US Fed funds rate at 3.75%-4%, with further increases expected. Businesses were able to borrow cheaply, and invest in loss making business models while they grew sales volume: this is now harder in a world where debt is more costly.

As the ‘risk free’ rate increases, the valuations of growth stocks expected to generate a lot of money in the future, but which have low earnings now, decreases as the discount rate of those earnings to present value, increases. Therefore, value stocks which generate cash now will be more attractive to investors in 2023 vs loss making or marginally profitable growth stocks.

Howard Marks, a US supervinvestor makes the point in his recent’ Sea Change,’ memo that we have transitioned from a world of low interest rates to a more normalised world of interest rates, which should benefit bargain hunters, e.g. value stock investors. You can read the full memo here: https://www.oaktreecapital.com/insights/memo/sea-change

The post Growth stocks crushed by rising interest rates and outlook for 2023 appeared first on Real Worth Stocks.