NewPrinces (NWL): a European food producer at 6x EV:EBITDA, growing very fast through acquisition

Quadrupled in size in the last 12 months, with a strategic pivot into supermarkets

NewPrinces (NWL) Investment Thesis:

NewPrinces (NWL) listed on the Milan stock exchange in Italy, have achieved a 42% CAGR in revenue since 2016 through acquisitions and growth, but are rated at 6x EV:EBITDA, below comparable food producer/supermarket competitors. Management execution is critical here: the thesis is that they will most likely continue their track record successfully buying and integrating food manufacturing businesses e.g. Princes. Another critical part is that they can successfully integrate and turn around their July 2025 purchase of the slightly loss-making ~1000 stores of Carrefour’s Italian business, leading to continued growth in the overall business and stock price. Management are founder-owner-operators, owning 41% of shares (economic interest), and 56% of the total voting rights, and have a clear vision of vertical integration in the food industry: from food processing to wholesale/retail distribution, developing new products, and driving operational efficiency and cash creation in their businesses. Downside risks are limited by the company’s strong balance sheet.

Business Model

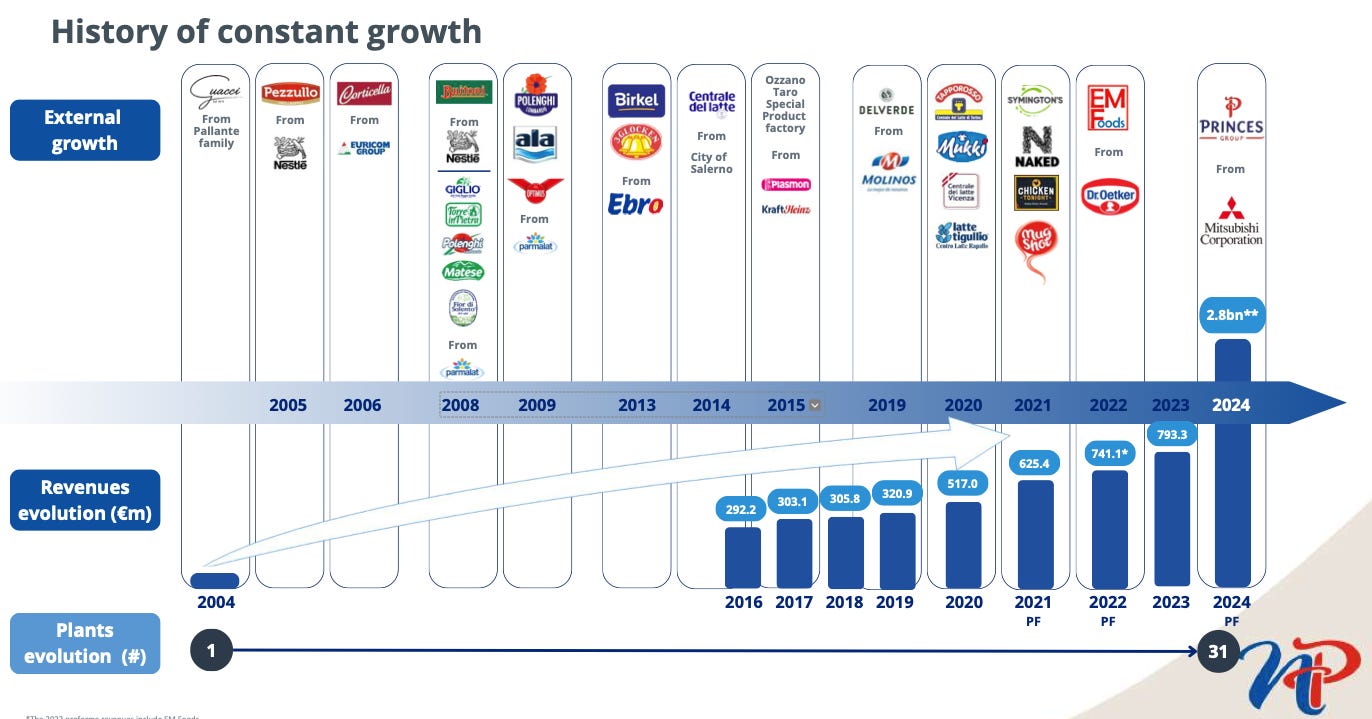

NewPrinces (previously called Newlat) is a fascinating business due to the hugely ambitious founder-led management: the Mastroli family: founder Angelo Mastrolia, his son Giuseppe Mastrolia, and his daughter Benedetta Mastrolia. The founders have taken the company from owning only the Guacci pasta factory in Italy in 2004, to owning all the brands in the graphic below. Significant recent acquisitions include:

2014: Centrale del Latte d’Italia (Italian dairy): cost ~€30M, loss making when purchased, and turned around to become profitable.

2021: Symmingtons (UK instant noodles etc.): cost £53M, at 5.7x EV/EBIDTA

2024: Princes (Fish, tinned goods.): cost £700M, at 0.39x P/S and 4.2x EV/EBITDA.

Note that this does not include three acquisitions made in 2025: including the transformative acquisition of the ~1000 stores of Carrefour Italia: more on these later...

NewPrinces Business Strategy up to 2025 (pre Carrefour Italia acquisition)

Operate its business efficiently to maximise cash generation: (fully utilise factory capacity, minimise working capital, etc.)

Use that cash for acquisitions: (plus also using debt, and occasionally equity) to acquire other food production business, with associated manufacturing plants and brands: often from distressed sellers

Integrate acquisitions into the existing businesses to generate more cash: by realising economies of scale, cross selling products, and developing new products to fill factory capacity, especially private label/customer owned brand, all of which generates cash: which can then be used for further acquisitions and growth.

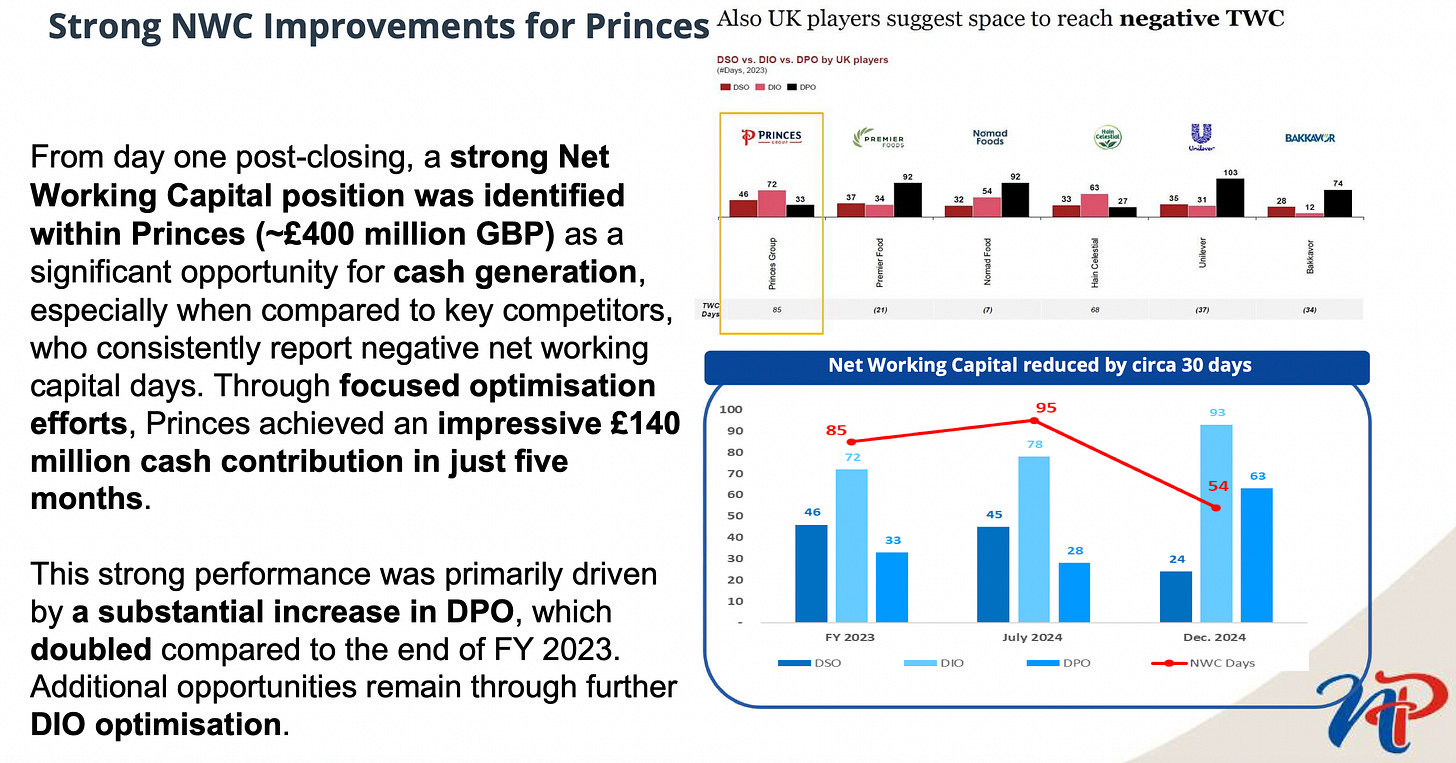

An example of working capital improvements is shown by the acquisition of Princes: with a potential £400M of working capital improvements identified, with £140M delivered so far - by increasing DPO: (the number of days that payables are outstanding), to better align with competitor norms. DIO (days inventory outstanding) can also be further optimised - to hold inventory for less time, according to NewPrinces.

Carrefour Italia acquisition (July 2025)

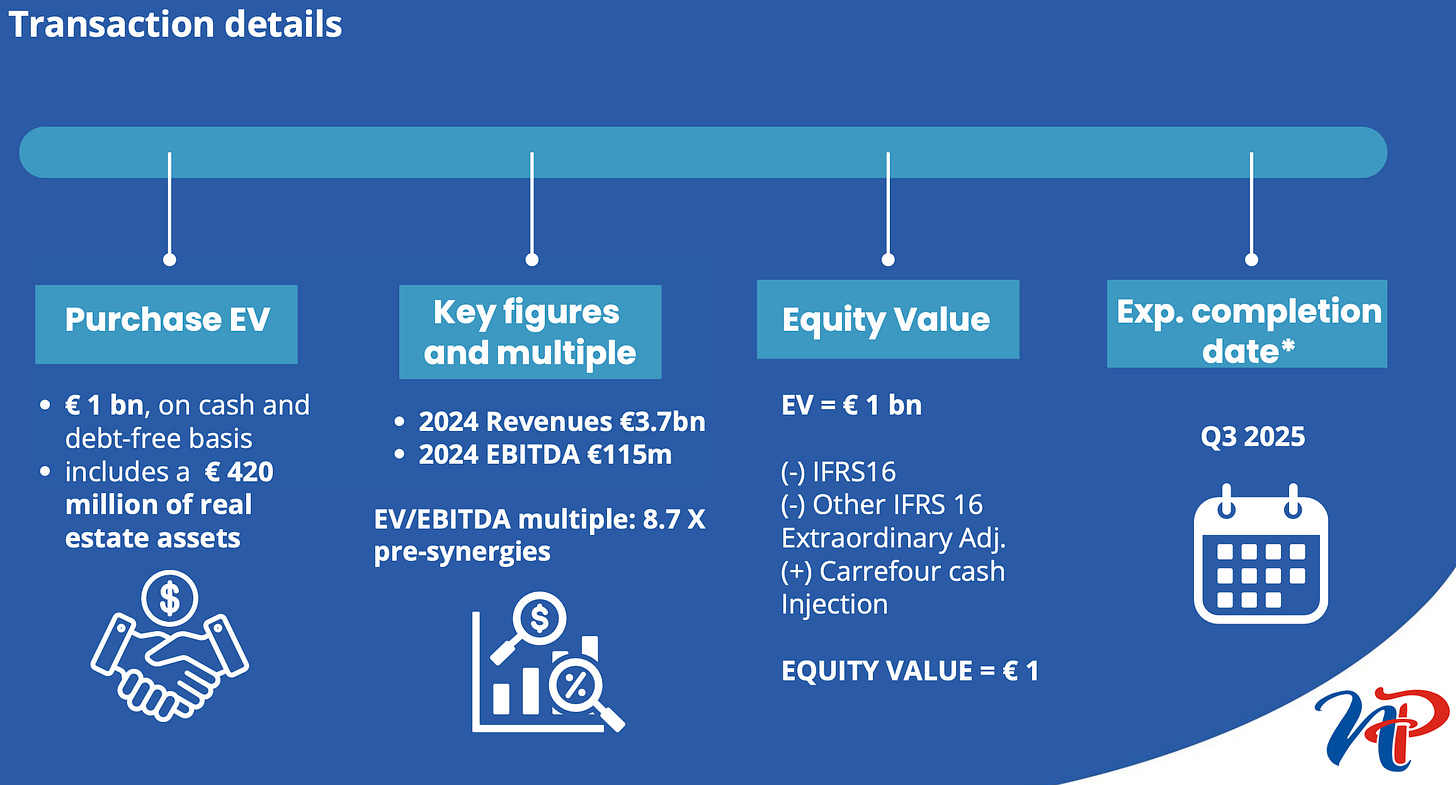

A hugely significant pivot in strategy, in June-25 was the purchase of the slightly loss-making entire Carrefour business in Italy as shown below: 1027 supermarket stores for an equity value of €1, but an enterprise of value of €1B: including €420M of real estate assets. This is expected to complete in Q3 25. With revenues of €3.7B (90% from food sales), this doubles the size of NewPrinces, after already doubling 12 months ago when buying Princes.

The graphic below shows Carrefour Italia locations and market share in Italy.

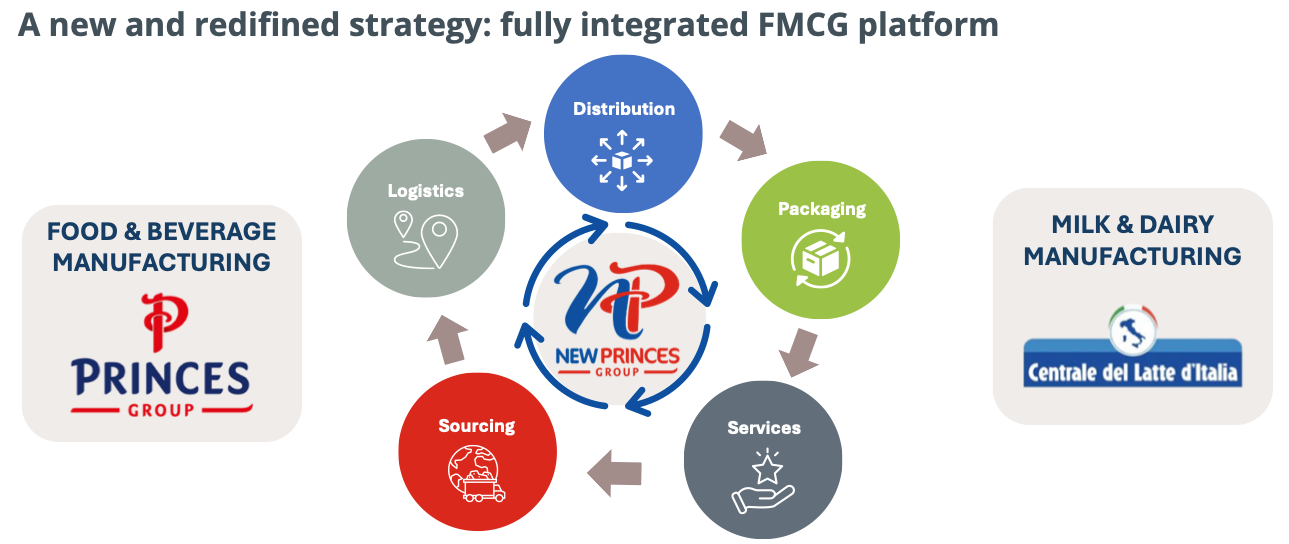

NewPrinces have communicated a new group strategy as in the graphic below. Angelo Mastrolia, NewPrinces founder and CEO, said in his interview on the Carrefour acquisition, that they were open to additional acquisitions in logistics and distribution, in order to form a multi-national conglomerate. This is a major change in strategy for NewPrinces, occurring with this acquisition. Interestingly, on the day it was announced the stock closed down 9%, but the next day and subsequent days, recovered all of its losses and has since gone up further: showing disagreement between investors about the the merits of this move but an overall positive consensus.

Angelo Mastrolia paints his vision of vertical integration for Carrefour Italia and NewPrinces as follows:

'In Switzerland, two big supermarket players like Migros and Coop already control the entire process from production to distribution, and Lidl is also thinking about it. We are inspired by this model, and also by the history of Luxottica, although this is a different product sector. Thirty years ago Leonardo Del Vecchio was only an eyewear manufacturer, but he fulfilled his destiny when he realised that he also had to have his own network of sales outlets'.

He also plans to revert to using the GS brand in three years time after refurbishing the Carrefour stores: this brand the one used by the stores that Carrefour bought when they entered the Italian market in 1993, and then they later phased it out in 2010. Other plans are to:

Focus on home delivery, since NewPrinces already has a strong logistics network in large cities in Italy.

Serve hotels/restaurants/cafes more effectively, through the combined NewPrinces and Carrefour Italia logistics network

Offer more private label products for sale in the supermarkets

Product ranges:

NewPrinces Dec-24 product ranges with revenues for each, prior to the Carrefour acquisition, are shown below:

2024 EBITDA margins range from 6%-14% depending on product type; a helpful table is given in the NewPrinces 2024 annual report on page 297, with the drinks and fish EBITDA margins being about 4%-5% (from the Princes acquisition) - these are likely to improve over time as NewPrinces improves the efficiency of the Princes business.

Competition and Market

The food production business is quite competitive. A risk is that a competitor may arise with greater economies of scale, and/or better distribution than NewPrinces, and reduce their sales volumes or margins in a particular food category. NewPrinces manages this risk by:

Remaining relevant: continually innovating to introduce new products to follow marketplace trends

Diversification by product type: This continues at pace with expansion by acquisitions in 2025, into baby formula, and alcoholic and non-alcoholic drinks.

Geographically diversifying (into Italy, Germany, UK, etc.) where different competitors are dominant in different geographies

National Brands vs Private Label/Customer Owned Brands

A brief explanation of national and private label/customer owned brands:

Products from national brands such as Heinz ketchup are purchased by a retailer for sale, but owned and manufactured by another company. The retailer benefits from the advertising that the brand owner/manufacturer does, and can sell the branded goods at a high price point because the customer wants that specific product, but this also means that the brand owner has a strong negotiating position in terms of the price that the retailer pays to stock their brands: so profit margins for the retailer can be squeezed by the brand owner/manufacturer.

Private label on the other hand, involves a retailer creating a brand that it owns, but which is manufactured by a third party manufacturer: most of NewPrinces revenues come from this. Historically, this has been done on less premium/lower cost goods. Customer Owned Brands (COB): there is an industry trend for retailers to also create their mid level and premium food product brands called COB by NewPrinces. For these brands, NewPrinces states that price is not the most important factor, but comes behind product quality, innovation and service. Their COB outperform national brands in terms of quality and perception, in the customers eyes, but at a lower price point, and for the retailer, allow them to capture more of the value when the products sell.

NewPrinces state that they have signed 2-5 year agreements with supermarkets, to produce COB in order to develop longer term relationships with them: vs the typical short term manufacturing tenders used in the industry. This shows that they have some competitive strength: that the retailers are willing to lock into these longer term contracts.

Economies of scale/low cost producer competition: that NewPrinces may not be able to be as competitive on price as larger competitors: this risk is mitigated by the constant acquisitions and actively scaling up the business. Revenue has compounded at a CAGR of 42% in the last 9 years, mostly through acquisition, and NewPrinces is now a €6.9B revenue business. They also seek to fully utilise their plant capacity, to exploit the operational leverage of manufacturing and reduce costs.

Moats/barriers to entry and exit:

Barriers to entry: Due to the high capex requirements to build food production facilities, the likelihood of their business being significantly disrupted by a competitor is low - it is very hard for a competitor to drive NewPrinces out of business. This is principally because although a competitor may compete successfully with NewPrinces in one product line or category, they are sufficiently diversified by product type and geography that this could not threaten the overall business. As NewPrinces scales, they have also increasing advantages in cross selling products across distribution channels, and increased bargaining power with raw material suppliers. They are building their economy of scale advantage as they grow revenues and make acquisitions.

Barriers to exit: competitive exits happen in the food sector mainly by selling out plants to competitors. Food manufacturing businesses have high fixed costs and a lot of invested capital in their factories. Therefore, when a plant/family of products is unprofitable, it is much easier for a company to sell a loss-making plant, than to incur the cost, psychological pain, and reputational damage of shutting it down, laying off all staff, and selling/remediating the land the factory is built on - which is at least a 1-2 year process. There is also a political cost for the company of shutting down an operation: this can be clearly seen by protests when closures are publicised in advance, as was the case in Diageo Italy. Therefore, when a food business line and associated food manufacturing plant is consistently unprofitable, it is better financially and reputationally, for the company to sell it rather than shut it down. Since they are a forced seller in this situation, a low price is typically achieved, well below the replacement cost of the assets - which is an opportunity for NewPrinces. It does not build factories: it just buys them below replacement cost typically from distressed competitors. Typically, these factories are running at only a fraction of their capacity (which is why they are loss making) and so if NewPrinces can fill them to capacity, perhaps by bringing in other products, or increasing sales volumes, they can make them profitable again.

NewPrinces has a great track record of taking advantage of the situations where poorly run competitors wish to exit their businesses, and have purchased multiple loss-making businesses from competitors, and turned them around to profitability. This track record indicates that a) operational execution in this industry is key, and therefore that in order to confidently predict the future track record on a company, an investor should look for continuity of management personnel: so that they know that operational excellence will continue into the future. NewPrinces is very strong in this regard, with it being a family owned and operated business: the founder Angelo Mastrolia is only 61 years old, and the second generation of the family (Giuseppe and Benedetta) are leading at board level, and in their late 30s/early 40s.

Capital Structure

NewPrinces has a single class of shares, but in quirk of the share structure rules, if shares are held by the same person for more than 36 months continuously, then the voting rights are doubled. Accordingly, Angelo Mastrolia has 41.4% of the shares but 58% of voting rights for NewPrinces, which had a net cash position at year end 2024. In Feb-25, it issued €350M in bonds with 6-year duration, at 4.75%, at par value. After the Carrefour acquisition and two others in 2025, it will have net debt of 1x EBITDA, about €330M.

Capital Allocation

Management have allocated capital primarily to acquisitions: and this being a key part of their strategy, is worth a close look to see if they are creating value or not.

Major acquisitions include:

Princes Group in Jun-24 (from Mitsubishi), for €700M (€650M cash, €50M stock), to repay the loan that Mitsubishi had made to Princes Group: it had €2B revenues with adjusted EBITDA of €118M. Since acquisition, NewPrinces significantly reduced the amount of working capital in the business, by about €179M, effectively reducing the purchase price by releasing cash from the business. They commented that part of this was achieved by lengthening the days until payment of payables, to industry standard norms.

Diageo Italy: in Dec-24 Diageo announced that it would shut its sole Italian plant in order to focus on stronger Northern European markets. In June 2025 NewPrinces bought Diageo’s Italian operations. The price has not yet been made public since the transaction is being finalised, however the annual revenues were €229M with EBITDA of €20M and net profit of €18M. It’s therefore too early to tell whether NewPrinces obtain a good price: although this is highly likely since Diageo had decided to close and liquidate the business, which would have not returned much if any cash to Diageo, so NewPrinces had a very strong negotiating position.

Kraft Heinz Italian baby food business: in July 2025 NewPrinces bought a manufacturing plant in Latina, Italy, along with various baby food brands, for €120M, at 7.1x EV/EBITDA. (In 2015 NewPrinces also had bought an infant formula factory from Kraft Heinz Italy).

A key point regarding capital allocation is that NewPrinces have not had to issue much debt or equity in order to grow their revenue at a CAGR of 42% from 2016-2025.

Princes business unit: listing on the London Stock Exchange in October 2025

NewPrinces are planning to list the Princes business unit on the LSE in the UK, in October 2025, aiming to raise about £700M, which will likely be deployed in further acquisitions and prompt further growth. This will also bring greater awareness of and publicity to the company in the UK and across Europe.

Durability, Quality & Risks

NewPrinces core business is quite durable: they produce food: private label and also branded consumer staple goods which will always be in demand. Much of their business is private label, but they do also own some consumer brands.

The new acquisition of Carrefour supermarkets in Italy is also a durable business, with no risk of obsolescence. However, there are some risks due to the aggressive acquisition strategy pursued by NewPrinces, which are discussed below.

Quality of earnings:

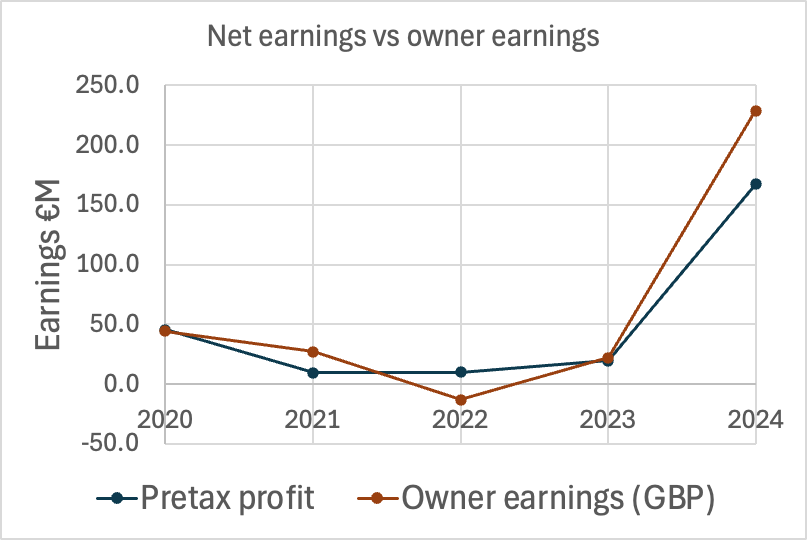

Owner earnings are calculated as the cash earnings that can be taken out of the business or reinvested, according to Warren Buffet’s formula: net profit + non cash expenses (e.g. depreciation, amortisation) - cash expenses not included in net profit (e.g. interest paid, taxes, capex).

I have calculated owner earnings for 2019-2024 as below. The deviations between them are due to working capital movements, but on average they correlate well. Owner earnings are actually higher than reported net earnings over the period by €57M, due to the working capital reductions in 2024 after the Princes acquisition.

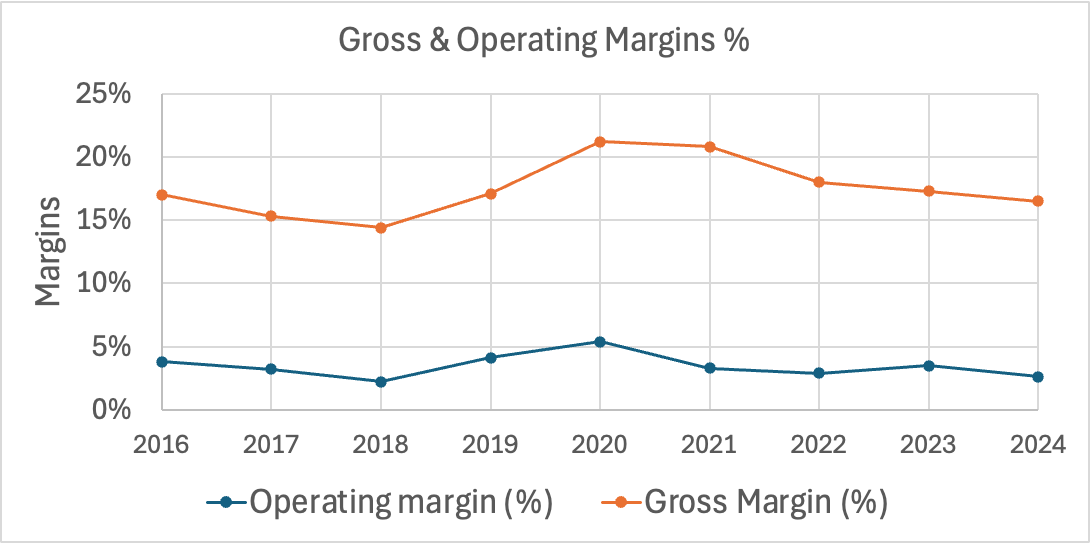

NewPrinces gross and operating margins are shown below: gross margins are between 15%-20%, and operating margins 3%-5%. This will likely change due to the acquisition of Carrefour Italia, which has been operating at EBITDA margins of about 1.8% in 2024.

Risks

NewPrinces fails to turn around Carrefour Italia to make it profitable: and so losses in the supermarket business offset profits in the food business, reducing overall profitability and cash generation. It made a loss of €87M on sales of €3.7B in 2024.

This is the most significant risk in my opinion, because of the large size of Carrefour Italia: which has revenues of 54% of the total business. It is a risk of a) business strategy, and b) execution.

a) Business strategy risk: this is the risk that it is the wrong strategy for NewPrinces, and even if executed really well, may still not pay off because they are choosing to be part of a very competitive industry. However: in chosing to buy Carrefour Italia, NewPrinces is following the model of Migros and Coop in Switzerland, which are vertically integrated food producers and retailers - showing that this strategy can be a successful model. In the case of Co-op (a business owned by members rather than shareholders), they target a maximum of 5% EBITDA margins: passing on savings to customers to avoid exceeding this level, which is much higher than the current 1.8% EBITDA margins that Carrefour Italia has in 2024: this shows that there is room for improvement in profits, while achieving commercial success. NewPrinces has also publicly committed to plans to ensure that it does not undercut other distributors of its products by selling them cheaper in the Carrefour Italia supermarket, than they are listed for in other supermarkets. Buying Carrefour Italia to enter supermarket retail is significant pivot in the strategy for NewPrinces, so it remains to be seen if this will be successful.

b) Execution: this is the risk that the acquisition is a good strategy: but will not be executed well by management. NewPrinces management have not managed a large supermarket before: and there is a saying that retail is in the detail: so will they be able to successfully manage the supermarket well, and make it profitable, if they lack the experience to know which details to focus on for good execution? Retail is an extremely competitive business, where your competitors can see everything that you are doing in stores daily - nothing is hidden - so there can be no trade secrets as a source of competitive advantage. The execution risk in my opinion is the single biggest risk since it is somewhat hard to quantify. Reducing the risk financially, is that NewPrinces took on Carrefour without taking on debt, and also Carrefour are investing €237M in the business to help NewPrinces make it profitable.

This truly is a transformative acquisition, that will likely either be a success, or else a mediocre acquisition that dilutes NewPrinces returns, and distracts its management. My opinion is that it will be a success is based on:

The track record of the management at ensuring operational efficiency of their many manufacturing plants, which definitely requires attention to detail

Their experience with managing complex supply chains and many product lines

Their total commitment to the success of the business since almost all of their family wealth, and time and attention is invested in NewPrinces.

Therefore, I think that they will be able to turn around Carrefour Italia. Their strategy for doing so has been discussed above in the ‘Carrefour Italia July 2025 Acquisition’ section.

Growth

Growth at NewPrinces has been at a revenue CAGR of 42% from 2016-2025, driven mostly by acquisitions, but also some organic growth in their businesses.

In the period 2016-2024, they grew revenue from €0.3B to €1.6B, while in cash terms, spending only €93M of cash to 2024 to buy the assets acquired.

For 2016-2025, the cost of the growth of revenue to €6.9B also includes an as yet unknown amount on Diageo Italy, €200M of cash on Carrefour Italia and an unknown figure, less than €120M, on Kraft Heinz Italy. Therefore, they have created a lot of value with the acquisition strategy over time.

For Carrefour Italia, there is significant scope for growth and operational improvement, with sales per square meter at €5.7k, vs the Italian supermarket average of €7.7k. If they closed half of this gap by improving sales using the existing retail floor space, this would be a sales increase of 18%, which would hugely increase profits due to the operational leverage inherent in a retail business (with an increase in revenue, since most costs are fixed, this results in a disproportionately large increase in profits).

NewPrinces forecast a CAGR of 3% organic growth to 2030, in line with market trends, without any synergy benefits from combining their recent acquisitions. They are also targeting a 10% EBITDA margin by 2030, up from 6.6% in 2024, driven by, ‘synergies, mix improvement, brand business contribution increase and operating leverage.’ These figures were published before the Carrefour Italia acquisition.

Management are actively involved in M&A discussions with multiple other businesses as below. For instance, these two acquisitions would increase revenue by 10% each.

Environmental, Social and Governance Factors:

Environment:

NewPrinces has a net zero plan, with the ratio of scope 1 and 2 carbon emissions declining over time. 15% of the board’s variable bonus is tied to this goal. NewPrinces was ranked as being among the, ‘most climate-conscious companies’ and received the ‘Sustainability Leader,’ award from Statistica.

Overall, climate risks were judged to be of low significance to the profitability of the business.

Sustainability targets for Newlat Food Group:

2028: 100% sustainable palm oil used

Princes Ltd targets:

100% renewable electricity: 2032

Reduction of 50% scope 1 and 2 greenhouse gas emissions: 2032

Reduction of 50% scope 3 greenhouse gas emissions: from purchased goods and services, upstream transport and distribution, and waste generated in operations, and reduction of 90% by 2050

100% sourcing of MSC-certified tuna for Princes brand in the UK and Netherlands: 2025

100% FSC certified paper and cardboard: 2026

Social:

NewPrinces employ 13,000 people in Italy, and 18,000 worldwide, post the Carrefour Italia acquisition, with 82% of their workforce covered by a collective bargaining agreement. Exceptions to this are in the UK and Poland where less than 100% of workers are covered by an agreement. In 2024 at NewPrinces there were zero deaths, and 15 work-related injuries per 1 million hours worked, which compares to about 11 per million hours for the UK: source is the UK Health and Safety Executive annual statistics 2023 report.

Governance:

Reading the annual report, I see a stricter regulatory environment compared to other countries in Europe with a lot of legal compliance regulations for Italian companies. Presumably this was put in place by the Italian Government, to combat money laundering and organised crime in Italy.

For instance, NewPrinces has:

An internal control and risk management system (ICRMS), which is itself also inspected by the internal audit department, by making regular evaluations of it through internal audits. Internal audit department head Fabrizio Carrara reports directly to the board.

Organisation, Management and Control Model in accordance with Italian legal decree 231: which includes documentation of the performance of controls. Nobody can operate an entire business process independently. A 2 person supervisory board also sends a written report to the board on how model 231 is being implemented in every company department.

A board of Statutory Auditors, voted on by the shareholders

External audits by PwC: term 2019-2027.

Key external audit matters in 2024 were:

Indefinite-lived intangible assets and impairment testing (product brands): these are worth in total about €47M: which is 5% of the balance sheet, so is relatively insignificant: and PwC found no issues with the valuation of these assets.

Business combinations: acquisition of the Princes Group: this was significant as a sum of €700M was paid to the seller Mitsubishi for Princes, checking that the actual accounting for this business, was as described in the financial statements, verifying the due diligence performed, and checking the value of assets and liabilities of the acquired business, and the accuracy of disclosures provided in the NewPrinces financial statement notes. Nothing of concern was found by PwC when this was done.

The overall impression I have when reading about the governance controls at NewPrinces is that they are strong and effective. In addition, the management are very focussed on cash generation rather than creating accounting profits. They have adopted an unusually aggressive depreciation policy for land and buildings, depreciating them over 10-33 years. Normally, businesses do not depreciate land. This may be to reduce their taxable profits, while still maintaining good cash generation - and is a sign that management do not care about maximising taxable profits to look good to investors, bur rather are focussed on owner earnings/cash management.

Appraisal

NewPrinces is difficult to value on a free cash flow plus growth basis, due to the multiple acquisitions, some of which are in progress. However, it can be valued on a price:book basis, and an EV:EBITDA basis.

Price:book: as of end of FY2024, NewPrinces has a balance sheet with net current assets of €501M, and net non-current assets of -€198M, for net assets overall of €303M. The market cap is currently €1038M at the time of writing.

However, since FY24 end, NewPrinces purchased three companies: we don’t currently know the book price of the Diageo Italy or Kraft Heinz Italy baby food businesses. The Carrefour Italia business was purchased for an EV of €1B cash and debt free, but an equity value of €1 after accounting adjustments, with NewPrinces committing €200M to revamp the stores (and Carrefour committing €237M as well): and Carrefour Italia has €420M of real estate assets. Therefore, very little cash has been required upfront to purchase a business with annual revenues of €3.7B and EBITDA of €115M.

The book value of NewPrinces is therefore currently not known since we only have figures to the end of 2024, but the FY24 balance sheet likely understates the true value of their assets, because the replacement cost for their assets is at least €400M more than the book value (this is the accumulated depreciation to date on their assets: most of which is plant and machinery).

EV:EBITDA: This is a more useful way to evaluate NewPrinces company, than price:book.

NewPrinces is currently trading at 4.8x EV:EBITDA, based on the current EV, and Dec-24 year end EBITDA.

However, since then they have purchased three businesses: so we can calculate an updated EV:EBITDA number:

Starting with FY24 EV of €681M:

+ €1B for Carrefour Italia

+ €120M for the Kraft Heinz Italian baby food business

+ an unknown amount for the Diageo Italy acquisition: let’s assume NewPrinces paid a 8x EV:EBIDTA multiple for the business, for an EV of €163M.

= 681+1000+120+163 = €1964M EV.

NewPrinces said in the investor presentation on the takeover of Carrefour Italia, that the combined EBITDA including the existing businesses, Carrefour Italia, the Kraft Heinz baby food business, and Diageo Italy would be €330M in March 2025. Therefore, an up to date EV:EBITDA ratio is €1964M/€330M = 6.0x: this is before synergies are realised in the acquisition of Carrefour Italia. This is cheaper compared to a comparable food company: Valsoia S.p.A (VLS), an Italian food company manufacturing and selling drinks, dairy, ready meals, and tomato based sauces trades at 9.8x EV:EBITDA, whose revenues are flat over the last 10 years. A dataset of US grocery companies has an average EV:EBITDA multiple of 7.7x. Based on this, NewPrinces are priced slightly to significantly below the market comparators. Additionally, Carrefour Italia has accumulated losses of €874M for 2019-2023, which NewPrinces may be able to use to offset future corporate taxes on future profits from this business.

Criticisms of EBITDA and relationship to cash earnings for NewPrinces:

Charlie Munger has criticised EBITDA, calling it ‘bulls**** earnings' because it does not take into account interest, taxes, depreciation and amortisation or capex, so it generally overstates the cash earning power of businesses. We can examine NewPrinces 2024 EBITDA to see how it compares to cash earnings:

EBITDA = Earnings Before Interest: NewPrinces’ net interest bill was about €30M in 2024.

T = Taxes: in 2024, NewPrinces paid only €7.2M in taxes on a profit of €167M, because it was able to save €47M in tax, using accounting losses from the acquisition of businesses, to almost totally offset its tax liability: reducing its effective tax rate from 27.9% to 4.3%. It is likely that by acquiring Carrefour, it will be able to do this for two or more years into the future as well - so not including taxes in EBITDA has little effect.

DA = Depreciation and Amortisation. DA can be compared to capex to understand the true cost of maintaining the assets of the business. In 2024, NewPrinces charged €63M of depreciation and amortisation against profits, but only spent a net €20M on capex - so that is the true cash cost to the company. Since the EBITDA number does not include DA or capex: we have to subtract them both to get to cash earnings.

Working capital: working capital adjustments are not included in EBITDA either: and here in 2024, NewPrinces managed to reduce working capital by €172M, primarily in the Princes business. It is hard to tell, if this will be repeated in 2025 with Carrefour Italia: it is likely that working capital will be reduced as the product lines are optimised and inventory reduced, however: additional working capital may be needed to restock the supermarkets with the product lines that NewPrinces wants to sell.

Leases: we need to also deduct €19M of repayment of leases from the EBITDA to get to cash earnings.

To summarise: FY2024 EBITDA can be adjusted to cash earnings by:

EBITDA = €261M - €30M net interest - €7M taxes - €20M capex - €63M depreciation & amortisation + €172M working capital reduction - €19M lease payments = €294M cash coming into the business. (Note - for the Princes acquisition: the purchase price paid was €155M less than the net asset value: since this was provisional at year end 2024, it is charged against profits, so EBITDA is €294M - €155M = €139M.

Therefore, cash coming into the business in FY2024 is lower higher than EBITDA. However, management identified a €465M working capital position in Princes, compared to competitors who generally have a net negative working capital position - so more working capital may yet be released from Princes.

If they bring Princes to a zero net working capital position, then the net cash cost to NewPrinces for the acquisition will be reduced from €814M-€465M, to just €349M, for Princes, a business generating €118M in EBITDA in 2024, and with revenue of €2.1B. Additionally, the planned ~£700M listing of Princes on the LSE in Q3/4 2025, will allow NewPrinces to raise cash from it’s equity holding of Princes and use that money for further acquisitions and growth.

Conclusion:

NewPrinces has successfully pursued a model to date, of buying distressed food businesses and associated manufacturing plants from competitors, along with some profitable businesses, increasing their efficiency, releasing working capital diversifying and realising economies of scale, and using the cash generated, to reinvest in more acquisitions, creating a lot of value. NewPrinces are forecasting organic growth of at least 3% CAGR to 2030, plus 6.6% to 10% improvement in EBITDA margins (excl. Carrefour Italia acquisition).

In 2025 NewPrinces pivoted strategy to pursue vertical integration in the food industry, buying Carrefour Italia to move into retailing products in supermarkets too. Overall, it has achieved a revenue CAGR of 42% in 2016-2025 through mostly acquisitions. It is a family owned and controlled business, and management execution is key to the future success of the business. At an EV:EBITDA ratio of 6.0x, slightly below competitors, there is some margin of safety - which also comes from the relatively strong balance sheet of the company with net debt at 1xEBITDA post recent acquisitions: but a key question is: can management execute the successful integration of the large, transformative Carrefour Italia acquisition? The investment thesis rests on evaluating management’s operational track record to date in the food manufacturing industry, and hypothesising that their plans for vertical integration in the food business will work. Is this empire building or a brilliant strategic move? Time will tell: probably it will become much clearer by Q3-Q4 2026. The investment thesis rests on having confidence that management can continue to deliver operational excellence, and also execute further valued added acquisitions.

Disclaimer: this is not investment advice, and is for informational purposes only. While every effort has been made to ensure the accuracy of information contained within, no guarantee is given as to the accuracy of information or fitness for any purpose.

Disclosure: the Real Worth Stocks portfolio holds a long position in NewPrinces (NWL) at the time of writing.