Vertu Motors (VTU): A profitable UK car dealer trading below net tangible book value

Vertu Motors is a car retailer & service company, selling new and used cars, and car servicing from 160 locations in the UK.

Vertu Motors business description

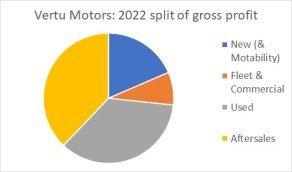

Vertu Motors operates in four segments, and the split of gross profit from each is shown below.

2022 gross margin per car sold is £1930 for new & motability cars, £978 for fleet & commercial, and £1739 for used cars. Vertu has 205 locations in the UK: sales per location are £17.6M, gross profit per location is £2.1M, and net profit per location is £0.29M. Given the total value of property, plant & equipment of £254M, this is a PP&E value of £1.2M per location, which is a net return of 23% on assets.

However, 2022 was an exceptional year due to constrained supply in the car industry: which led to shortages of new vehicles, which in turn raised the price of used cars as demand for these increased. This has continued in late 2022, and is expected to return to more normal conditions in 2023, which will reduce gross margins.

Competition in the UK & US car industry

The UK car industry is extremely fragmented: Vertu Motors is the 4th largest car dealer in the UK with annual sales of £3.6B: but it only has a 2.5% share of UK new car sales and about 1.2% share of used car sales. There is no dominant player in the industry: e.g. the market leader is Sytner Group at £6B revenue – still only ~5% of new car sales.

Vertu was formed in 2006 specifically to roll up/consolidate the UK car retail industry, and has grown rapidly through organic growth and acquisition. There is a long runway for future potential growth as the industry consolidates further. Some publicly listed competitors to Vertu are shown in the table below: all are UK based apart from Sonic Automotive, which is a US car dealer.

Company

Ticker

Price: sales

Gross margin 10Y median

Operating margin 10Y median

Revenue 10 Y CAGR

Price: net tangible book

Gross margin coef. of variation

Vertu Motors

VTU:LSE AIM

0.05

11.1%

1.00%

13%

0.48x

4%

Lookers

LOOK: LSE

0.06

11.3%

2.15%

8%

0.84x

12%

Pendragon

PDG: LSE

0.09

12.3%

1.90%

0%

1.70x

43%

Motorpoint

MOTR: LSE

0.10

7.6%

1.90%

14%

1.57x

6%

Sonic Automotive

SAH: XNAS

0.16

14.7%

2.70%

5%

3.02x

2%

The UK car market overall is priced cheaply relative to the US car market: e.g. Sonic Automotive is priced at 3x net tangible book price, vs a max. 1.7x for Pendragon. This is partially because Sonic is much more leveraged: carrying $1.5B of long term debt vs a $1.75B market cap: the UK car dealers have in comparison very little long term debt. Pendragon’s share price is inflated at the time of writing, since they have received a preliminary takeover proposal from Hedin Mobility at the end of Sep-22, which caused the share price to increase by about 25% to just short of the proposed offer price.

Durability, Quality & Risks

In order to evaluate earnings durability, it is important to consider the effects of Covid and the semiconductor shortage. Vertu – like all other UK car dealers had to close it’s physical locations during the short lockdown period in March-June 2020. This temporarily reduced profits.

Then, there was a global shortage of semiconductors and new car production reduced during the Covid pandemic, which led to a shortage of new cars, which also greatly increased used car prices: which strongly benefitted Vertu: so it made a record profit before tax of £83M in 2022 (year end Feb-22). This level of disruption is very unusual in the UK car retail industry.

Durability: earnings are expected to fall in FY 2023 (Mar-22- Feb-23). Over the 5 year period 2015-2019 operating margins were 0.8% – 1.1%, with a median of 1.00%, and gross margins were 10.8%-11.1%, with a median of 11.0%. Vertu has very little variation in gross margins over time. If we assume that earnings in 2023 normalise to pre-Covid levels and revenue remains flat at £3.6B, this would suggest earnings of £36M, and a P/E ratio of 4.4 or earnings yield of 23%.

Quality of earnings: Vertu reported a profit of £85.7M in FY 2022, and cashflow from operations of £90M. Due to the accounting treatment of leases, the true cashflow is about £16M less than this. Depreciation is roughly equivalent to PP&E spending, and there is an increase of £28M in working capital. In order to see the true free cashflow available to shareholders, the owner earnings can be calculated. This is done by taking net profit, and adding back non-cash expenses e.g. depreciation, and subtracting capital expenditure. Owner earnings vs reported earnings are shown below.

Owner earnings are much more volatile than net profit, because they take into account working capital movements, e.g. changes in the inventory of cars. Over the period 2015-2022, net profits were £195M and owner earnings were £166M: the difference can be accounted for in spending on capital expenditure. Therefore owner earnings were about 15% less than reported net profit, so the reported earnings are of fairly good quality.

Risks to Vertu Motors

Supply side driven higher prices: The supply constraint in new and used cars will not continue forever. At some point, the supply will increase and prices are likely to fall. Gross margins and net margins at Vertu and other car retailers will be reduced, leading to lower profits.

This has not happened yet: Vertu made a profit of £28M in the first half of it’s 2023 financial year, which is what I estimate it’s normalised earnings to be in a full year. The exceptional earnings of £83M in 2022 will not be repeated in 2023. However, if we assume that a P/E ratio of 10x is normal, with the current market cap of £150M, the market is pricing in that the earnings will be just £15M: which has not been the case since 2014 (excepting 2020 in which there was a 3 month lockdown with dealerships closed from March-June).

The key point is that the current pricing is for permanently lower profits, below historical levels. Although there may be a temporary hit to profits if there is a UK recession, there is no reason to believe that profits will be permanently lower.

Move to digital and online: there are some new entrants in the UK car market, e.g. Cazoo, an online car retailer, who raised a lot of money on the equity markets, and are currently loss making.

Customers have been slower to adopt car buying online than other products.

In 2017, Vertu was the first UK car retailer to offer a fully digital buying experience. In 2021 the Click2Drive brand was launched, and also an online concierge service, blending online and offline methods to sell cars, e.g. providing customers with video tours of cars.

Vertu is increasing it’s efforts in the digital space, e.g. by appointing a Chief Technology Officer in 2022, and has a 50 member software development team. It also migrated it’s servers to AWS cloud in 2022, and is using an online booking system for aftersales, valeting, services booking etc. Therefore, Vertu is well placed to compete with other competitors in the digital space.

Inflation: the UK has seen significant inflation, currently at ~10%, with rising energy prices. Vertu has stated that their current electricity contact with below-market pricing ends in October 2022. They are targeting an annual 10% decrease in electricity consumption across their business, and are investing £1.8M in LED lighting at all workshops.

Interest rates are rising in the UK, the Bank of England base rate is currently at 2.25% as of and a large increase is expected in November, possibly 1% with further increases up to perhaps 6% in 2023. This could affect Vertu in two main ways:

…. To access the full Vertu Motors write-up, including: Effect of inflation, capital allocation, growth, management integrity, ESG, our appraisal and conclusion… and to get monthly stocks picks in your inbox, timely buy & sell alerts, access our entire archive of stock picks & much more, click below to become a Real Worth Stocks member:

To read more stock write-ups from Real Worth Stocks, please visit our A-Z stock write-ups page here.

Disclaimer: this is not investment advice: please refer to our full terms and conditions below.

The post Vertu Motors (VTU): A profitable UK car dealer trading below net tangible book value appeared first on Real Worth Stocks.